Webcast #31: The U.S. Jobs Picture Isn’t So Strong (5 minutes)

Last Friday, the U.S. Bureau of Labor Statistics (“BLS”) said 372,000 jobs were added during June, far exceeding the 250,000 new jobs that economists had guessed.

Almost immediately, investors feared the economy is stronger than believed, inflation will keep rising, and the Federal Reserve will have no choice but to continue hawkishly raising interest rates to tame inflation. Higher rates drive asset prices lower, including stocks.

The BLS’s monthly job report is both highly inaccurate and certain to change with its future revisions. The BLS surveys about 150,000 businesses (out of 6 million total) and revises their original jobs estimate in the next month’s report… and then again another month later. But no one every pays much attention to the revisions – after all, that was then and this is now.

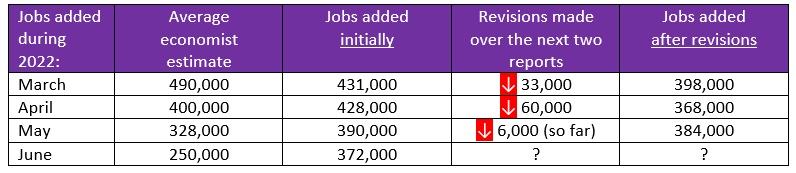

The BLS has been diluting their original monthly estimates for much of this year.

Aggregating March, April, and May together, the BLS initially reported 1.249 million jobs were collectively added over those three months. However, revisions have slashed this figure by 99,000 jobs, or 8% of the initiate estimate. That’s a pretty big change.

Look at April. Economists guessed 400,000 jobs were created that month. Following the BLS’s report, Forbes wrote: “The U.S. added back another 428,000 jobs in April, performing better than economists expected as the strong labor market recovery encourages Federal Reserve officials to more aggressively raise interest rates in their fight against inflation.”

The S&P 500 fell -3% over the next week.

Yet, the number was ratcheted down to 368,000 over the next two months (remember economists originally thought 400,000 jobs were added). Despite fear over exceeding the estimate by +7% but in truth actually missing it by -8%, no one mentioned it… cared… or even noticed.

In addition to April, both March and May’s numbers were subsequently revised lower as well. If 2022 is a trend, we would expect June’s reported job gains to revise lower as well.

We believe inflation has peaked, particularly at a time when gas prices fell -7% over the last month in the U.S. (-13% in Ontario, including the tax reduction). With arguments that strong employment will drive inflation higher, we question the premise that employment is as strong as many suspect. In addition to these downward revisions, stories of rescinding offers and hiring freezes within the technology sector are becoming more common.

The slowing employment environment, downward revisions to new jobs added, and evidence of peak inflation offer the Federal Reserve reason to begin pausing its aggressive rate hikes. Doing so would provide a long overdue stock market rally.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.