Time to Cash Out

There’s a substantial about of cash sitting on the sidelines. As investors start rotating back into equities as interest rates fall, we expect to see stock prices move higher.

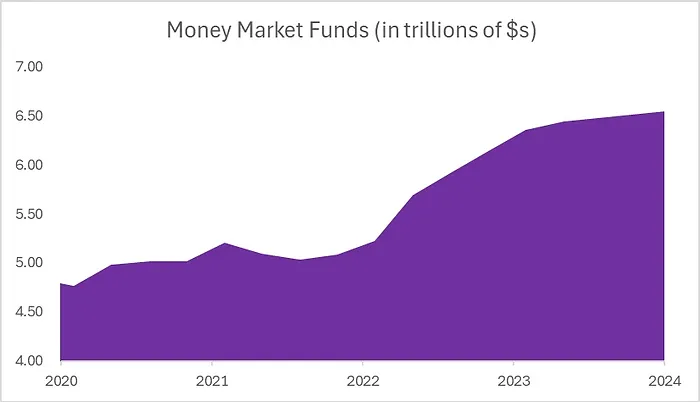

Currently, a staggering $6.5 trillion is parked in money market funds in the U.S. These funds function much like cashable guaranteed investment certificates (GICs), offering a reasonable interest rate. However, the upside is limited to the interest income, leaving investors with only a fixed return.

Since interest rates began climbing in early 2022, an additional $1.5 trillion has flowed into these money market funds. To put that into perspective, $1.5 trillion represents approximately 3% of the S&P 500.

Born in 1946, the eldest baby boomer is now 78 years old. The need for reliable income is becoming increasingly critical. While many retirees have turned to less volatile investment vehicles like money market funds to preserve their capital, as the rates on these funds begin to decline, we may see a shift in strategy. There’s a growing likelihood that retirees will look toward dividend-paying stocks to meet their income needs.

Bond yields, too, will fall in the years ahead. It’s important to recognize how the bond market dwarfs the stock market in size. The global debt market is approximately $300 trillion, while the global equity market capitalization is about one-third of that amount. This disparity suggests that anyone with a bond maturing in the next few years may shop around in other asset classes to replace the lost income upon seeing that yields are significantly lower than they are today.

At Schneider & Pollock, we’ve made strategic investments, including the purchase of shares in Charles Schwab, a prominent U.S. brokerage. We acquired this stock during last year’s regional banking crisis for about $55/share. Recently, management noted a turning point in investor appetite for higher yielding securities. Schwab anticipates that as interest rates decline, investors will rotate out of cash and back into stocks. In response, shares rallied +6% on Tuesday to nearly $72/share.

If a significant portion of the cash sitting in money market funds begins to flow back into equities, we expect to see another leg higher in stock prices.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.