Lessons Learned from the “Nifty Fifty” of the 1960s

The “nifty fifty” was an informal group of stocks that traded at high valuations (over 50 times earnings in many cases, far above the historical market average of about 16 times) in the 1960s and early 1970s. The “nifty fifty” was responsible for strong market gains on the way up, only to provide disappointing underperformance in subsequent decades on the way down.

The group’s underperformance is a perfect example of the disappointment that follows unrealistic investor expectations when buying pricey, expensive growth stocks.

So far this year, seven stocks are responsible for almost all of the market’s return. Those names include Apple, Microsoft, Nvidia, Amazon, Meta (formerly Facebook), Tesla, and Alphabet (formerly Google).

These hype and hyperbole behind these seven stocks could easily reverse. While not trading at dot com valuations, many of the names listed above accompany excessively expensive valuations, not all that different from the “nifty fifty” levels several decades before.

We don’t believe in timing the market. You should always be fully invested. Selling your stocks because you think the market might fall 10% is a loser’s gamble. I’ve met many investors but not one who could ever successfully time the market on a consistent basis. Since 1928 (as far back as our data source goes), the S&P 500 has been green two-thirds of the time and produced a 5.8% return before dividends. That includes the Great Depression, OPEC crisis, Dot Com crash, 2008 financial crisis, and COVID-19 (to name only a few of the crises over the last 95 years).

But, we do believe in actively monitoring the stocks you own and selling an expensive name to buy one that is cheaper.

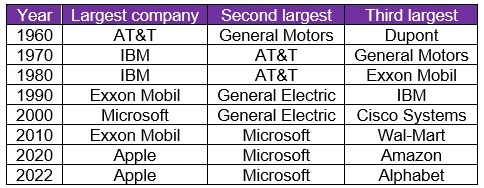

Have a look at the top three largest stocks by market capitalization (which is the stock price multiplied by the shares outstanding) since 1960.

As you can see, leadership rotates over time.

The lifespan of a company represented on the S&P 500 is declining. At the beginning on the 1970s, it was almost 60 years. Today, it’s about 15 years.

While today’s stars tout the innovation and forward-thinking that has attracted investor interest, tomorrow’s dogs are the companies burdened with massive size and unable to maintain their growth… just like the nifty fifty.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.