It Works to Bank on the Past

Purchasing the worst-performing Canadian bank stock over the last twelve months has historically posted impressive future gains in the year ahead.

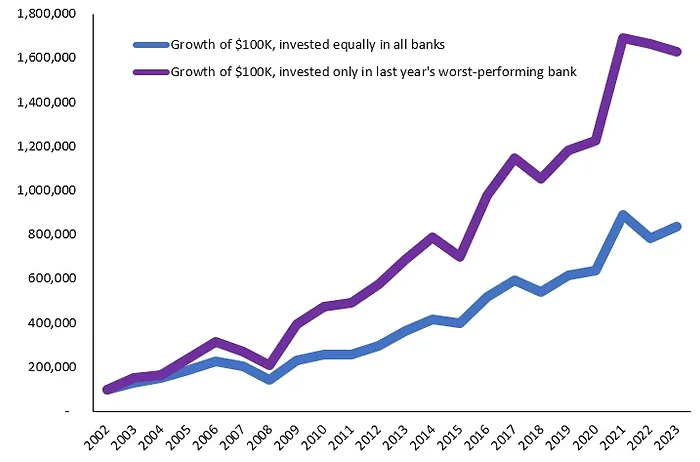

Have a look at the chart below. Employing that strategy over the last two decades resulted in double the capital gains. This data doesn’t include the regionals (Canadian Western Bank and Laurentian Bank) as we’re only looking at the big six institutions (RY, TD, BNS, BMO, CM, and NA).

Be mindful of taxes. So, do this in an RSP/RRIF or TFSA to shelter your gains.

As of this writing on December 27, Scotia is on track to deliver the worst 2023 performance compared to its banking peers. Scotia’s stock price is down 2.1% this year and that’s after falling almost 23% last year. In other words, Scotia has been the worst-performer two years in a row.

There is precedent for a bank to post the worst performance two consecutive years in a row. Going back the last two decades, we’ve seen it happen three times. In every instance, the third year has always delivered positive price performance and in 2 out of those 3 occurrences, the bank that underperformed two years in a row posted the best price growth during the third year.

Those three instances were:

- In 2003 and 2004, Royal Bank was the worst-performer. In 2005, its price climbed 46% and it was the best performing bank stock that year.

- In 2012 and 2013, CIBC was the worst-performer. In 2014, its price climbed 15%.

- In 2014 and 2015, Scotia was the worst-performer. In 2016, its price climbed 39% and it was the best performing bank stock that year.

Scotia once commanded a premium valuation because of its exposure to Latin America but now trades at a discount. Recently, its new CEO Scott Thomson (who comes from outside the financial services industry, though he served on the company’s board of directors) said he wants to focus on North America. That includes Mexico, which has promise as companies move away from China to onshore production. With a dividend yield just under 7%, not much needs to go right to achieve a double-digit return in 2024. For that reason, Scotia is our favourite large cap Canadian bank stock.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.