Charles Schwab Got Thrown Out with the Bathwater

At the end of June, the Federal Reserve released the results of its annual stress test for the big U.S. banks. The exercise, which was introduced in 2011 following the 2008-2009 financial crisis, tests to see how the big banks’ balance sheets would fare in a hypothetical economic downturn. The results of the test dictate if any banks need to set aside additional capital, which directly affects the amount that can be returned to shareholders via dividends and buybacks.

Twenty-three banks participated and all passed this year’s stress test.

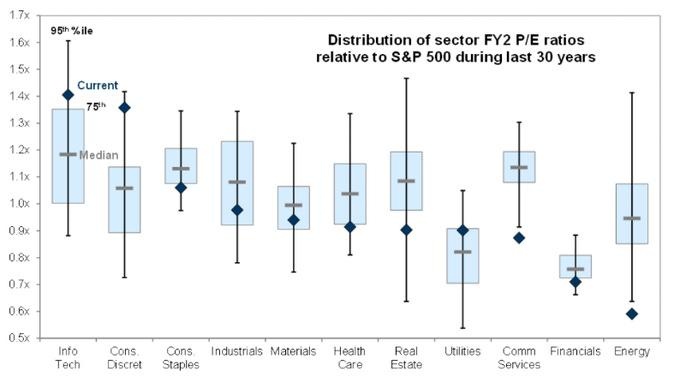

Since the regional banking fallout in March, which saw Silicon Valley Bank collapse, financial stocks have seen their valuation multiple compress, which presents a buying opportunity for investors. As seen in the chart below, which illustrates the price-to-earnings ratio for each sector relative to the S&P 500 over the last 30 years, financials are currently trading at a discount to the market and at the bottom of their historical range.

During the March selloff, we took advantage of Charles Schwab’s share price decline and purchased stock for clients. Schwab closed at $82.57 at the end of 2022 and dropped to the $50-range by March.

We weren’t the only ones doing so. Schwab’s CEO put down almost $3 million of his own money to buy 50,000 shares on March 14.

Schwab got sold off along with regional banks, falling over 35%. Although Schwab does have some banking activity, the company is predominantly a brokerage that allows investors to buy and sell securities.

Because of its purchase of TD Ameritrade in 2019, Toronto-Dominion Bank owns 12% of Schwab.

Today, Schwab’s stock trades below 14 times earnings. Historically, it has usually traded over 20 times earnings. In the last decade, its valuation range has been 13-14 times (in years 2011 and 2022) to as much as 30 times (2010, 2013, 2014, 2015, 2017, 2021, and 2022). The stock is trading today at a trough valuation and represents a great buying opportunity.

We believe this stock should trade at 20x earnings – in line with its historical multiple – and expect the stock to rally over 40% over time to its intrinsic value of $80 per share.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.