Blog: Our Views on Diversification

On February 16, investor Charlie Munger answered investment-related questions for several hours. Munger and Warren Buffett have been business partners at Berkshire Hathaway for many decades. When asked about diversification, Munger said:

I think the great lesson from the Munger’s is that you don’t need all this … diversification. You’re lucky if you’ve got four good assets. If you’re trying to do better than average, you’re lucky if you have four things to buy. To ask for 20 is really asking for egg in your beer. Very few people have enough brains to get 20 good investments.

On the other side of the coin, ARK founder Cathie Wood appeared on CNBC the next day for a much anticipated one-hour interview to defend her investment strategy, which invests strictly in disruptive technology stocks. These companies are overwhelmingly in the early stage of their business life cycle and do not yet generate profits.

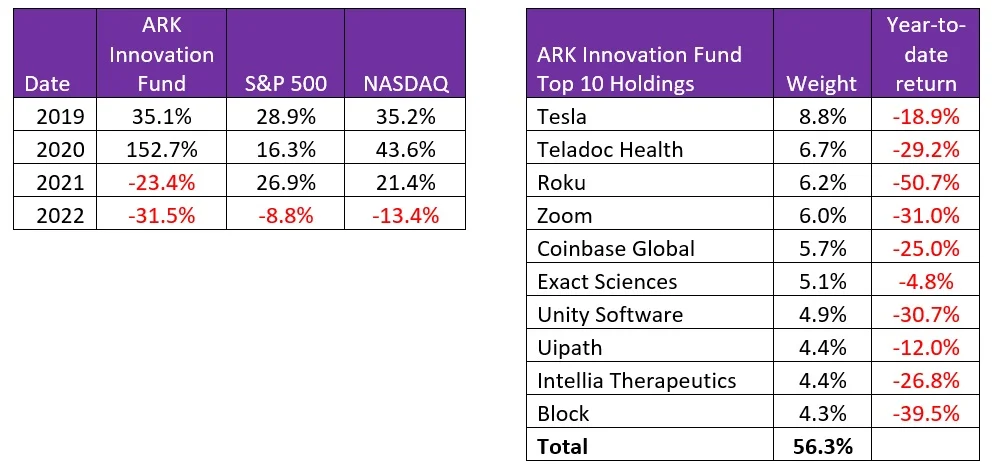

Throughout the pandemic, the ARK Innovation Fund received widespread praise for its performance. As central banks collectively cut rates to provide supportive monetary policy, growth stocks benefitted the most. In 2020, the ARK Innovation Fund appreciated 153%. Following the announcement of a COVID-19 vaccine in November 2020, discussions began about higher rates and a return to normal. The ARK Innovation Fund price declined -23% in 2021 and is down another -32% so far this year.

The ARK Innovation Fund targets a specific niche. For that reason, its stocks all move in the same direction. When rates are falling, growth stocks do well. Recently, as higher inflation readings have increased the number of rate hike expectations, growth stocks have given back some of their prior gains and continue to fall.

Throughout Wood’s interview, she said “innovation is in bargain basement territory”, “[there is a] hysteric reaction to inflation”, and that her stock prices will return to prior levels “and beyond.”

What else was she supposed to say?

Even if Wood was concerned with higher rates and runaway inflation, can a technology innovation fund simply switch its top holdings from Tesla, Teladoc, and Roku one day to Exxon Mobil, J&J, and General Motors the next?

We would never own four stocks nor would we own one sector for any client with a decent-sized portfolio. It is sure to end in disaster if either a stock (which would be 25% of your portfolio) or the sector (100%) fell out of favour.

Our job is to earn a decent return but also manage your risk.

That’s not to say we need to own every sector or an excessive number of stocks. We believe in diversification but also in managing concentrated portfolios with fewer positions. Each stock should be at least 3% but not exceeding 7% of the portfolio (in order to manage risk). Depending on the environment, events occur when it is prudent to avoid particular sectors entirely. However, by diversifying, we can move quickly in and out of an idea and are not forced to defend a strategy that isn’t working or has cloudy days ahead.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.