When in Crisis, Always Bank on Charles Schwab

Anyone who lived through 2008 (or studied the 1930s) knows how frightening banking crises can be. The financial system runs on confidence, and once that’s shaken, restoring trust can take significant time.

In 2023, the U.S. regional banking sector faced its own crisis. It started in March with the abrupt collapse of Silicon Valley Bank (SVB), triggered by a bank run linked to an investment portfolio ill-prepared for rising interest rates. SVB’s failure was the largest since 2008. Days later, regulators closed Signature Bank. While these failures were mostly due to institution-specific problems, the resulting panic quickly spread, leading to a widespread selloff across the financial sector.

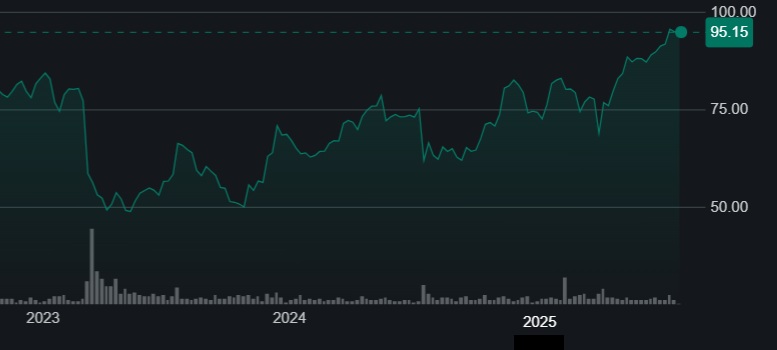

They say never to waste a good crisis. During the sharp 10% selloff in the financial sector that March, we sought opportunities with minimal risk. Market volatility often reveals mispriced stocks. On March 27, we added Charles Schwab (SCHW) to portfolios where suitable, acquiring shares at an average price just below $55 per share. At that time, Schwab’s valuation had dropped from its usual level of around 20 times earnings to under 14. (Disclosure: Jeff Pollock and Sunni Schneider directly and indirectly hold a financial interest in SCHW as shareholders.)

Our research made it clear that Schwab was well positioned to weather the storm. Although its share price dropped nearly 30% in the four weeks leading up to our purchase, Schwab was unfairly grouped with banks during the selloff. While Schwab does have a banking division, it is a diversified financial services firm, with revenue streams from asset management and trading, in addition to its banking operations (net interest revenue constitutes around half of its total revenue).

Today, Schwab’s stock trades around $96 per share. Including dividends, clients who participated in that initial March 2023 purchase are up almost 80%.

Schwab was one of the first companies to report earnings this quarter, and the results couldn’t be stronger. Earnings and revenue soared 56% and 25% year-over-year, respectively, both well above analyst expectations. Total client assets have now reached a record $10.76 trillion.

The company paused its share repurchase program in 2023. According to its Q2 report, Schwab resumed buying back its own stock, purchasing 3.9 million shares for $351 million.

Looking beyond the recovery, Schwab’s future growth outlook is very strong. Having acquired Ameritrade from TD several years ago, the integration is now complete, with all Ameritrade clients fully transitioned onto the Schwab platform. This consolidation is expected to drive profit growth by 47% this year, followed by 18% in 2026 and a solid 14% in 2027.

While the brokerage industry is highly competitive with rivals such as Robinhood appealing to a younger demographic, Schwab’s innovation pipeline will broaden its offerings. It has plans to launch direct crypto trading—likely within the next 12 months—starting with Bitcoin and Ether on its Thinkorswim platform, before expanding to Schwab.com and its mobile app. Additionally, Schwab recently announced an expansion of its 24-hour trading platform to cover more than 1,100 securities, available five days a week.

Schwab was never truly in crisis. It was a case of market mispricing—and a timely opportunity we were ready to act on. Given the strength of its platform and innovation pipeline, we continue to hold Schwab and add it to new accounts where appropriate.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.