December is Historically a Strong Month for the Market

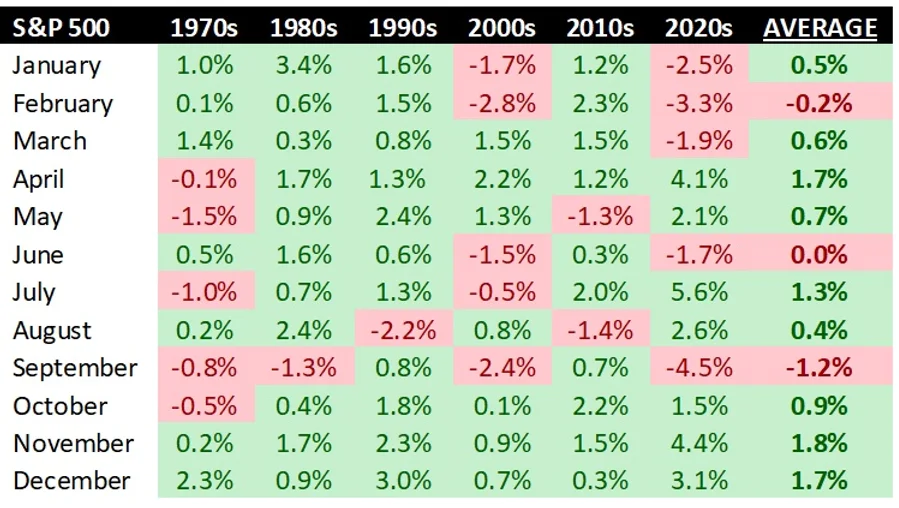

As Labour Day approached earlier this year, we wrote that September is historically the worst-performing month in the market. We expected volatility throughout the month and sure enough, that’s exactly what we received.

Using that same data, December is historically a strong month for the stock market.

Since the 1970s, the average return during December has been about 1.7%.

That ties for the second-best month of the year after November. In case you didn’t notice, the S&P 500 and the S&P/TSX Composite index rose 5.4% and 5.3%, respectively, last month.

With seasonal strength on our side, several other considerations support the continuation of last month’s rally to continue.

First, historical precedent suggests that when the S&P 500 contracts by 15% in the first half of the year, a 15% to 18% rally traditionally follows in the last six months of the same year. In the first six months of 2022, the index fell almost 21%. Since June 30, it has rebounded just under 8%.

Second, the market has appreciated by 14% on average since 1944 in the six months following U.S. midterm elections that take place in November. The strongest gains have accompanied a gridlocked Congress. This is because drastic changes in fiscal policy are less likely to occur.

Third, earlier today, U.S. Fed Chair Jay Powell said during a Q&A with the Brookings Institute that its was time to moderate future interest rate hikes. This long-anticipated announcement was welcomed news by the market.

As December approaches, we expect the rally to continue into year-end.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.