We Always Wanted to Invest in the Pet Industry — Now We Have Our Stock

If you have ever owned a pet, you can attest that they’re part of the family.

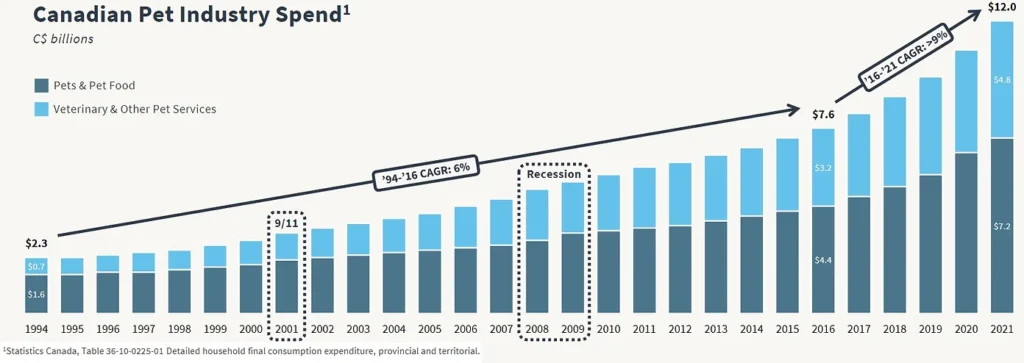

Few industries can boast about growing during the financial crisis. The pet industry, however, was one that did. As the chart below suggests, expenditures on pets, pet food, veterinary, and other pet services grew by a +6% compounded annual growth rate between 1994 and 2016. Between 2016 and 2021, that rate spiked to over +9%.

Pet ownership is now at an all-time high. During the pandemic, pet ownership grew from 67% to 70%. We believe that adults are more likely to adopt a pet if they grew up owning one in their adolescent years. With pet ownership higher now than ever before, we believe it will grow beyond 70% as many of today’s youth become accustomed to owning a pet.

Our latest purchase for clients is Pet Valu, a company that sells premium branded pet products and commenced trading shares in the public market in June 2021.

While we have always wanted to invest in the pet industry because of its resilient customer demand, Pet Valu has grown faster than its sector. We quoted above that the industry grew by over +9% from 2016 to 2021. Over that same time period, Pet Valu’s average same-store sales growth has been +11%.

It is the largest company in Canada’s pet market, commanding an 18% market share. Behind Pet Valu stands Petsmart (14%), Walmart (11%), Costco (8%), and Amazon (4%).

Last week, Pet Valu reported excellent earnings results and raised its guidance across the board. During the quarter, same-store sales increased +21.2% (excluding results from its acquisition in Quebec of Chico). For the fiscal year, the company expects same-store sales to grow by +13-15% this year compared to last, an increase from their previous +9-12% guidance. It also increased its earnings per share expectations to $1.47-1.51 this year, up from the previous $1.37-1.44 guidance.

Over time, Pet Valu envisions its store count climbing to 1200 location. That’s an increase of almost 70% from today’s roughly 700 locations. While 72% of Canadians live within 5 kilometres of a Pet Valu location, there’s much more opportunity for growth in the years ahead.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.