The Best Way to Reduce Portfolio Volatility and Save for Retirement

For younger investors presently saving for retirement, allocating a percentage of each paycheque to an investment account accompanies several benefits.

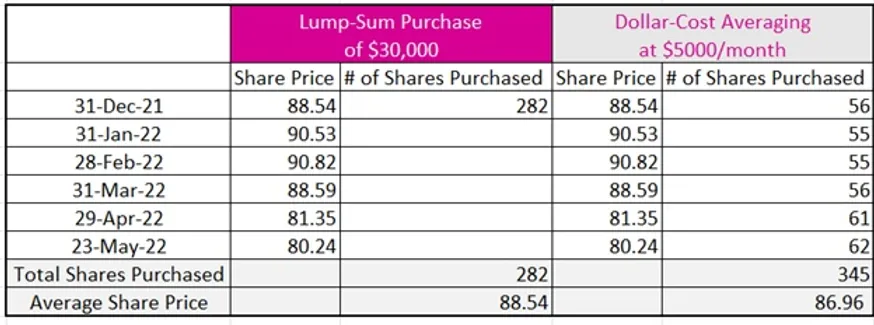

First, buying stocks at regular intervals rather than at one point in time will reduce the volatility within your portfolio. Take Scotiabank, for example. As the chart below suggests, a lump-sum purchase at the end of 2021 would have resulted in a higher price and fewer shares than if the purchase was evenly divided each month in 2022.

Second, timing the market is impossible guesswork, even for professional investors. No one has ever properly timed the market with consistent success and many who did so with luck in the past are often never heard from again. Staying invested or consistently purchasing stocks over a long-term interval is far preferred than jumping in and out of the market on a regular basis.

Third, emotions often cause investors to make poor decisions. The behavioural theory of loss aversion observes that human beings experience losses more severely than equivalent gains. Because of this overwhelming fear of loss, investors can often behave irrationally and make bad decisions, such as selling a portfolio during a market correction when in fact the investor should use the opportunity to make additional purchases.

Fourth, dollar-cost averaging creates a disciplined savings strategy. Paying yourself first before spending anything from your paycheque eventually becomes habitual. With time, this habit will create your retirement nest egg.

Overall, we believe that dollar-cost averaging is a prudent investment strategy, particularly for younger investors currently saving for their retirement.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.