Sell in May and Go Away?

The old phrase to “sell in May and go away” implies that investors (or, in this case, speculators) are best to sell their stocks before the calendar turns over to May and then buy them back as November approaches.

Data suggests, however, that this speculative trade is not one to execute.

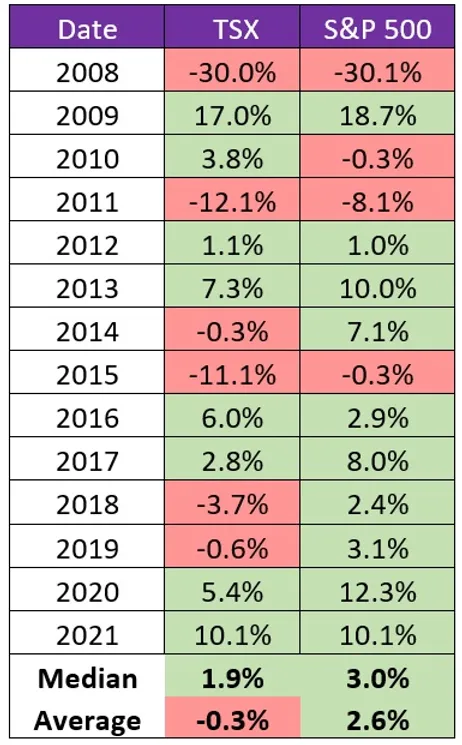

Since the financial crisis in 2008, the S&P/TSX Composite Index (“TSX”) has appreciated 57% of the time (S&P 500 has appreciated 71% of the time) between early May and the end of October. The median appreciation during those six months has been +1.9% on the TSX and +3.0% on the S&P 500.

Three notable declines have taken place over the last fourteen years, all of which were based on very fundamental global crises at the time. In 2008, the collapse of Lehman Brothers required unprecedented efforts to save the financial banking system from crumbling; in 2011, investor confidence dampened as the European debt crisis spiraled out of control; and in 2015, the collapse in oil prices brought down the TSX.

While we have discussed our caution at this time due to the rising rate environment, the mere fact that May is around the corner does not warrant liquidating a portfolio.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.