The Crude Facts About Oil

Commentary that the fossil fuel sector will decline and soon become obsolete – suffering the same fate of newspapers or the cable industry – is far from accurate.

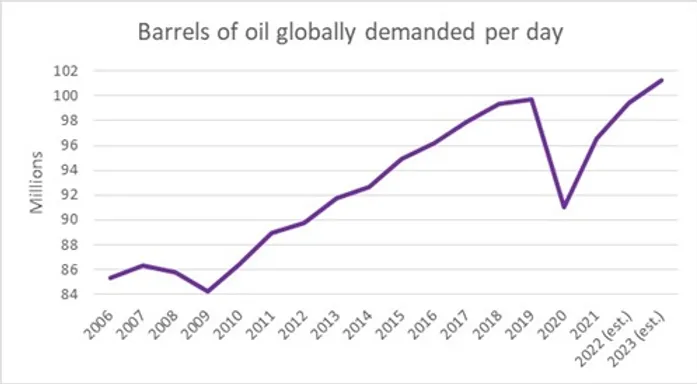

Next year, for the first time ever, the world will demand over 100 million barrels of oil per day. By comparison, the world needed 91.8 million a decade earlier and required 99.7 million barrels the year before the pandemic began.

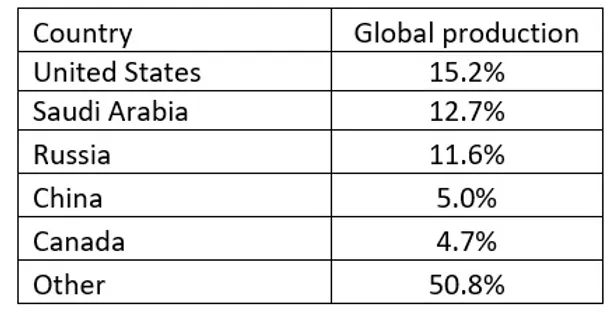

The demand for oil is just as relevant as its supply. With global tensions currently at the forefront because of Russia (the world’s third largest producer, supplying almost 12% of global oil production), we are seeing first hand the impact of a country-specific supply shock.

As the world’s fifth largest producer, Canada is a net exporter of oil, supplying more than our country requires.

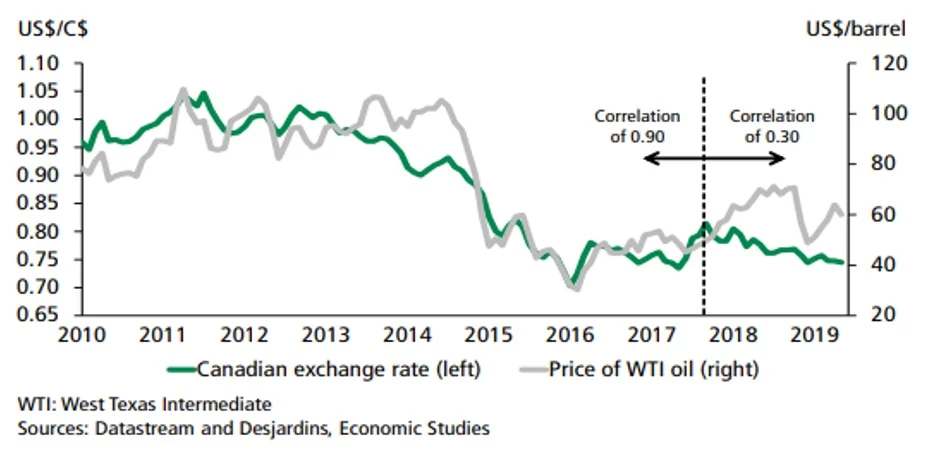

However, the loonie that once moved up and down in the same direction as the price of oil has diverged since the end of 2017. Despite oil prices ranging from $50 barrel to $130 over the last twelve months, the loonie has ranged from only $0.78US to $0.83US. Back in 2011 when oil approached $100 barrel, the loonie hit par with the US dollar.

Rapid increases in energy prices historically induce recessions. In the past, a recession has followed when the price of oil has doubled (1990, 2000, and 2008). Right now, the average Canadian gasoline price is $1.71 per litre and $4.32US per gallon south of the border, up a full $1US since the start of the year. Gas prices represent 3.3% of the average household budget, and each penny increase at the pump takes a larger bite out of everyone’s budget.

A recent study published by the Nature Research Journal used 39 years of wind and solar data to suggest that alternative energy could satisfy electricity demand in 42 countries. However, it would come at the cost of 788 hours of blackouts per annum, representing 9% of the year. While renewable energy can satisfy some electricity demand, it cannot supply the entire market.

Before the pandemic, many were calling energy stocks “uninvestible” because of ESG (Environmental, Social, Governance) concerns. Multiple large institutional money managers, including even the Rockefeller Foundation, pledged to divest all fossil fuel investments. In 2020, the energy sector declined by -37%, representing the worst group in the entire S&P 500 that year. In 2021, however, energy jumped to the top performing sector, appreciating +53% for the year. So far in 2022, energy continues to lead the market, up +32% since the start of the year.

The world still requires fossil fuels, and their displacement will not take place any time soon. Restricting the flow of oil creates higher prices and because its demand is inelastic (a fancy way of saying essential), recessions historically follow. While renewable energy may provide an alternative to fossil fuels, it does not have the capacity to supply the entire market. Betting against the energy market has proved costly the last 15 months. As pandemic-imposed restrictions relax, travel will resume and commutes shall return. Airplanes and cars both require fuel and gasoline.

As our “Investment Philosophy” page states, we are contrarian investors. Our experience has been that the best returns follow investments in sectors and stocks that trade out of favour with the public. Though the energy sector has performed well the last 15 months, it was heavily out of favour from 2015 until 2021. Many stocks within the sector trade at prices not far from their level a decade ago. For example, Suncor traded at $31.02 on March 18, 2011. One decade later, it trades at only $39.12. Should the sector pull back if Russia halts its unprovoked hostility towards the Ukraine, we will use this opportunity to buy selective companies with attractive dividends and solid Balance Sheets for new client money.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.