The S&P 500 gained during 100% of the years since 1948 whenever…

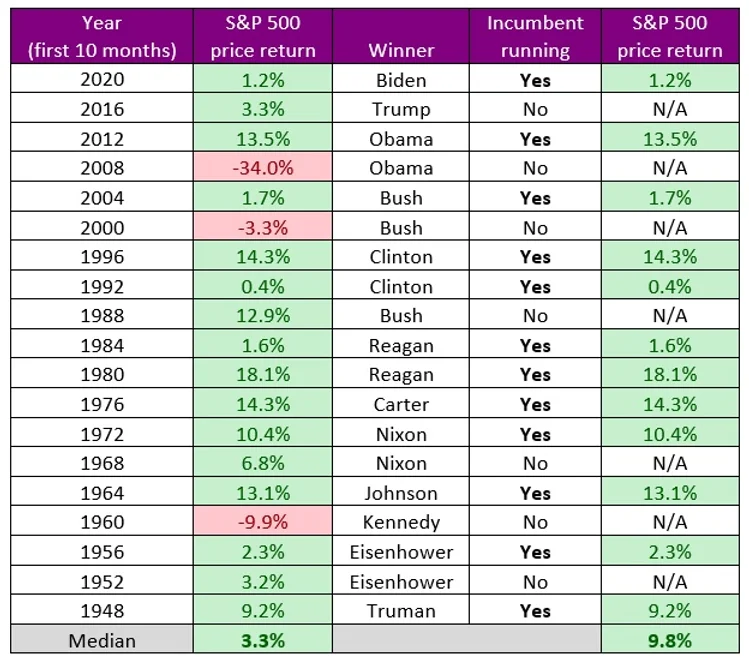

There has been a grand total of 19 U.S. Presidential elections since 1948. Because FDR served multiple terms and died in office, that’s as far back as we decided to go.

In exactly 300 days, the U.S. will go to the polls and mark their ballots.

The S&P 500 delivered a positive return between January 1 to November 1 in 16 of those 19 years. In other words, the market has gained ground 84% of the time in a Presidential election year. The median return in those first ten months leading up to the vote has been +3.3% since 1948.

However, it’s a different dynamic when an incumbent seeks re-election. Remember when Ronald Reagan asked, “are you better off than you were 4 years ago?”

Of the 19 elections since 1948, 12 of those races had an incumbent President seeking another term. Isolating only at those 12 election years, the S&P 500 was positive a full 100% of the time. Its median return has been an impressive +9.8%.

The outperformance in incumbent years makes sense. A sitting President running again would obviously want to win, and he has some levers to pull in order to create favourable conditions for the voting consumer come November.

We expect the market to do well in 2024. In addition to the favourable data in Presidential election years, a meaningful decline in interest rates will help bolster the market to new highs.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.