Santa Claus is Coming to Town

While both the S&P 500 and S&P/TSX Composite Index are flat so far this month, December is historically a great month for stocks.

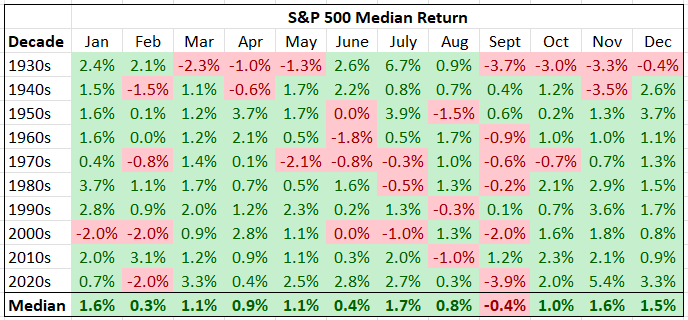

In fact, over the last hundred years, the only decade to post a negative median return during December was in the 1930s. All decades since — from the 1940s until the 2020s — have posted a positive median price return during December.

There are several reasons that make December a strong month.

For starters, many mutual funds have an October 31 fiscal year end, which means their tax loss selling is complete by the time Halloween rolls around (November is historically a strong month for stocks too, actually).

That brings us to the Santa Claus rally, which is characterized by a strong period for stocks in the last five days of December and the first two days of January. Retail investors finish their tax loss selling in December, though many don’t wait that late to sell their losing positions.

Other factors that account for a strong December could be the optimism and/or year-end bonus that the holidays accompany.

It could just simply be a self-fulfilling prophecy. Every professional investor knows about the seasonal strength in December. That being the case, many will surely buy stocks over the next several weeks anticipating a December rally to unfold. If enough people follow that logic, you can be sure the market will catch a bid.

Yesterday, the U.S. Federal Reserve cut rates by 25 basis points while the Bank of Canada left its benchmark unchanged. Because the prediction markets are pricing in a 75% chance that the next U.S. Fed Governor will be Kevin Hassett, we expect to see another 3 cuts south of the border next year, sending stocks higher.

As always, if you have any questions about your portfolio (or if you are looking for a portfolio manager), do not hesitate to reach out at info@schneiderpollock.com or 416-646-0756.

-by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.