What if Trump Wins?

We expect the market to propel higher regardless of the Presidential Election outcome on November 4.

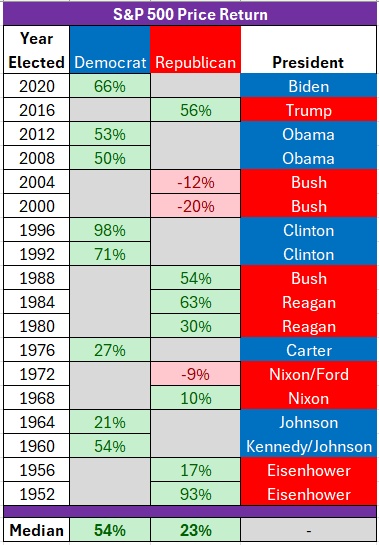

Between 1952 and today, the market has almost always driven higher regardless of the President’s political stripes.

There’s no question that the S&P 500 returns have been far superior under Democratic than Republican administrations. In fact, ever since Eisenhower was elected in 1952, the median return under a Democratic President has been +54% from the day after the President was elected until the day of the subsequent election four years later.

This is far superior to the +23% return during the ten four-year Republican administrations over the White House these last 72 years.

However, there are several outliers weighing down the Republican returns that should be adjusted.

The S&P 500 collapsed 20% during George Bush’s 2000-2004 term and another 12% from 2004-2008. However, that first term happened to coincide with the height of the “dot com” technology bubble, which crashed soon after Bush was inaugurated. Not exactly something Bush had a lot to do with. As he was leaving office in 2008, the great financial crisis was well underway, also a non-politically induced economic crisis.

We’ll leave Nixon in there – let’s face it, he was a little weird.

When taking out the Bush outliers from 2000-2008, the S&P 500 returned a +42% median return under a Republican four-year term – far better than the unadjusted +23% return.

And what about Congress?

Since 1926, the market performed best under a Democratic President and a divided Congress (+16.6% per year, on average). The market historically likes gridlock in Congress because it provides the predictability that little will get done. For stocks, the less uncertainty, the better.

Historical precedent suggests that the market will continue to drive higher regardless of the victor in November. For this reason, we expect the S&P 500 to hit new all time highs over the next four years.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.