The Data on “Sell in May and Go Away”

There’s a seasonal trade to “sell in May and go away” that some people follow. It requires an investor to sell their stocks in early May and then repurchase them back at the end of October.

It’s not a strategy we employ for our clients.

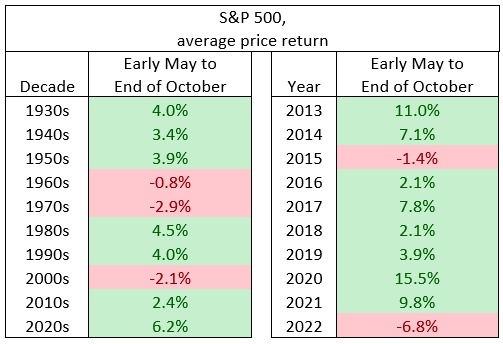

The data suggests that the market historically appreciates between early May and the end of October. In fact, going back to 1930, the S&P 500 posted a positive return during those six months 67% of the time (62 out of the 93 years). If you’re wondering, the average price return from early May through the end of October was 2.0% while the median price return was 2.7%. Add more if you want to include the dividends.

In the last ten years, it’s even worse. The S&P 500 has appreciated 80% of the time by an average 5.1% per year between early May and the end of October.

So, why pursue to this trade?

The theory is misunderstood. “Sell in May and go away” does not mean sell your stocks in May and sit in cash for six months. Instead, the theory is to sell your stocks and reinvest that money into interest-bearing fixed income securities between early May and the end of October.

Going back to 1930, the price gain of the S&P 500 from early November until late April has been 4.6%. That’s a full 2.6% higher than the 2.0% that the S&P 500 has gained from early May until the end of October.

If you can earn more than that 2.0% earning interest on a bond, why not do it? Well, that’s why this seasonal trade was discovered. Back in the 1980s, fixed income paid interest rates in the teens. In 1981, the 10-year Treasury yield was almost 16.0%. Sine then, however, interest rates have steadily fallen. Today, the 10-year accompanies a yield of 3.4% (which is up a lot from the near 0.5% it dropped to in 2020).

If interest rates were at a level comparable to the 1980s, this trade would carry more weight. But, rates are not nearly high enough to make it a wise one worth pursuing.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.