Remember, September is Historically a Bad Month

It’s difficult to dispute the seasonal weakness that September historically accompanies.

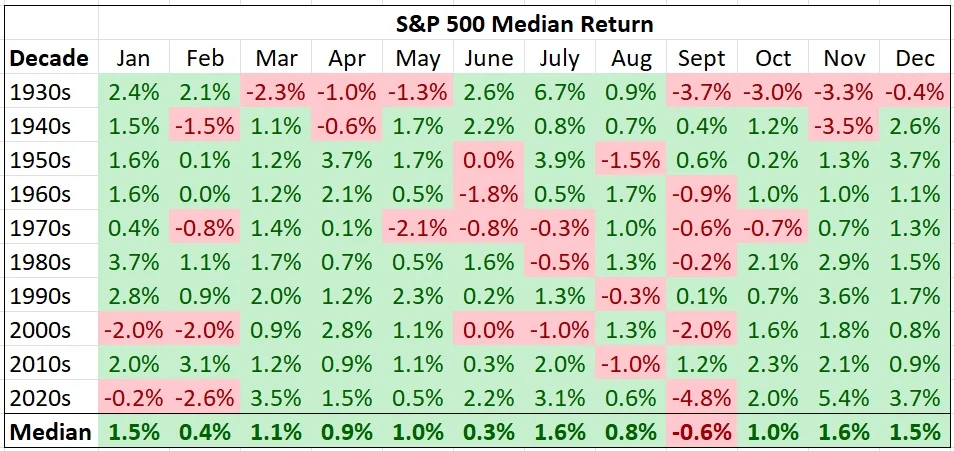

Many call it the “September Effect”. Going back almost a century, it’s the only month of the year when the S&P 500 quite regularly accompanies a loss. Since 1930, September has delivered a medium return of -0.6%. In fact, September has posted a loss 55% of the time over the last 90-plus years.

So far this decade, every September has declined without exception. Even worse, the declines have been more pronounced than the long-term average. (2020: -3.9%; 2021: -4.8%; 2022: -9.3%; 2023: -4.9%).

Why the market gains during some months but loses value throughout others is just about anybody’s guess. Sometimes it is related to tax planning; other times it appears random. Nevertheless, seasonality can become a self-fulfilling prophecy. If investors believe that September is a weak month, they may adjust their strategies accordingly, which can exacerbate a downturn. For that reason, it’s important to be aware of this historical data.

Despite the September Effect, stock prices appreciate in the long run. When looking back over the last century, the S&P 500 has posted a positive price return during 69% of those years.

This week, our firm identified client accounts with large, realized capital gains in 2024. Any securities within that same account that carry an unrealized capital loss will be sold ahead of the September Effect and bought back thirty days later. This will be done to mitigate the taxes payable next spring. Repurchasing a stock within thirty days would trigger the superficial loss rule by the Canada Revenue Agency, meaning that the loss would not be allowed to offset other gains.

Furthermore, in anticipation of lower interest rates, many dividend-paying stocks have been purchased within client portfolios over the last several quarters. We will use the accumulated cash positions now that several dividend payments have been made in order to take advantage of any weakness in September.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.