Never Risk Letting a Good Crisis Go to Waste

April didn’t just bring showers—it dumped a cold bucket of water on the markets.

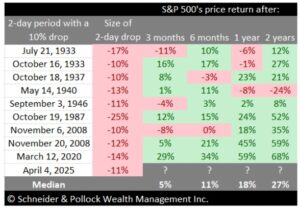

Following Trump’s worse-than-expected tariff announcement on April 2, the S&P 500 tumbled nearly 11% in just two days.

That kind of drop felt unprecedented—but it wasn’t. Since July 1933, the S&P 500 has fallen more than 10% over two consecutive days ten times. And what happened next? The numbers tell a surprisingly optimistic story:

- +5% median return after 3 months

- +11% after 6 months

- +18% after 1 year

- +27% after 2 years

Sometimes when it looks like the end of the world, it’s a buying opportunity in disguise.

Think back to March 2020: the globe was locked down, and no one knew when—or even if—a vaccine would come. Or rewind to 2008, when few could have predicted the sheer scale of central bank intervention. Panic now, profit later? Not always—but often enough that it pays to stay calm and invested.

It’s important to manage risk so that you can soldier through market sell-offs such as these. We manage risk for our clients in a number of ways.

First, we talk to our clients all the time. We know who just got a promotion, who’s dreaming about retiring early, who reads every report, and who hasn’t opened a statement in ages. That kind of personal connection is tough to pull off at a big bank, where advisors are juggling hundreds of clients.

These relationships let us manage two things effectively:

- Risk tolerance: how much volatility you can stomach, and

- Risk capacity: how much loss you can afford to take without compromising your life plans.

Second, portfolio construction is tailored to each client. We don’t let any single stock hog the spotlight. If something creeps towards 10%, it had better be curing cancer or inventing teleportation, because otherwise it’s getting trimmed.

We also diversify across sectors so that each client has exposure to many areas. This way, their portfolio doesn’t move in one direction every day. Some investments aim for growth. Others are there to provide income. Each piece plays its part, especially when the market throws a tantrum like it did earlier this April.

It’s been a bumpy month. But through it all, we stayed focused on what really matters: building lasting, resilient wealth.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.