Lost in Translation: How Currency Can Wipe Out Your Wins

The financial crisis of 2008 was a defining moment for me as an investor. Watching the panic unfold on Wall Street, with banks teetering and markets swinging wildly, solidified my philosophy to buy when others are selling.

One of my purchases during that period was Apple. In December 2008, I bought shares around $3.36 (adjusted for subsequent stock splits). The market found its bottom just a few months later in March 2009, and what followed was a remarkable recovery. A year after my purchase, Apple’s stock had nearly doubled, reaching $6.95 (split-adjusted). A quick double in a year? I was thrilled.

But then came the reality check.

My brokerage statement, while showing a fantastic return, indicated a gain of 76% – not the 100% I was expecting. What happened to my double?

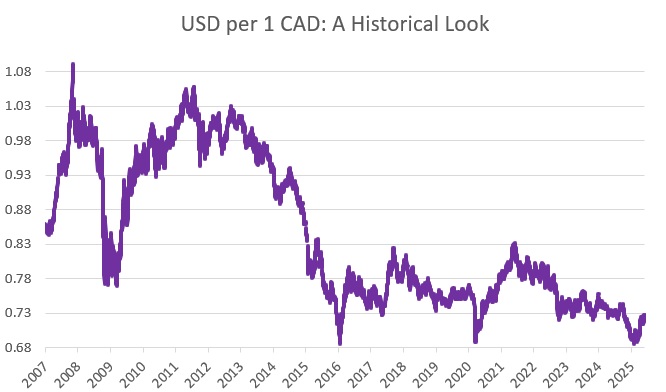

The culprit was an appreciating Canadian dollar, which effectively clipped 25% off my U.S. dollar-denominated gains.

This is a hidden pitfall many Canadian investors overlook. Currency fluctuations can significantly erode your returns. You can pick the right stock, at the right time, but if the exchange rate moves against you, your gains can be “lost in translation.”

That’s why today, we increasingly purchase Canadian Depositary Receipts (CDRs) for U.S. stock exposure. CDRs are Canadian-dollar versions of U.S. stocks, created by banks and listed on Canadian exchanges, designed to track U.S. shares while hedging out the currency risk. This means they strip out the currency movements, allowing you to focus purely on the underlying company’s performance.

We keep a close eye on the loonie. In January, we published a blog post titled Our Loonie Market, where we took a contrarian stance, predicting the Canadian dollar had likely bottomed at $0.69 USD. So far, at $0.73USD today, that prediction has held true.

Looking ahead, a potential shift in investor sentiment, perhaps fueled by the new government in Ottawa and its more business-friendly approach compared to the previous administration, could easily drive the loonie higher. For Canadian investors with U.S. holdings, this could mean another round of currency losses unless they’re strategically hedged.

If you’re unsure whether your U.S. holdings are currency-hedged, or if CDRs make sense for your strategy, reach out to us at info@schneiderpollock.com.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.