Gold Stocks will Shine Later this Year

Looking back over the last seventeen years, the U.S. Federal Reserve has cut interests rates over four cycles, each time for a different reason.

- 2007: the U.S. housing market began to soften.

- 2008: the financial system imploded.

- 2019: the “mid cycle adjustment” was needed after the U.S. and China embarked on a trade war.

- 2020: the Covid-19 pandemic shut down much of the economy.

After each occurrence (though not quite as much in 2019), gold stocks have historically rallied immediately following a rate cut and then climax about 2-6 months later.

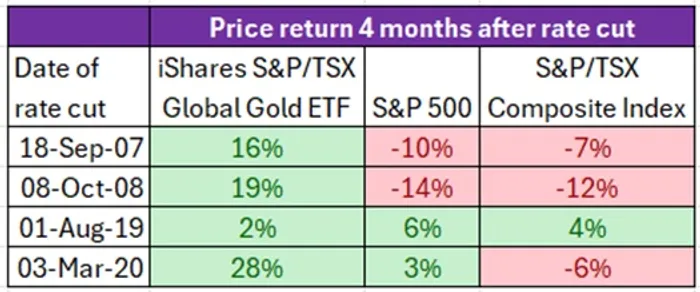

The chart below compares the price performance of an exchange-traded fund that owns a bunch of gold stocks and the market indices (the U.S.’s S&P 500 and Canada’s S&P/TSX Composite Index). The returns illustrate the price change 4 months after the first of several rate cuts that took place in 2007, 2008, 2019, and 2020.

There are several reasons why this happens.

First, gold is priced in U.S. dollars. As rates drop, so too will the value of the U.S. dollar. Whenever the U.S. dollar depreciates, the price of gold moves in the opposite direction and gains value. The reverse is true when the U.S. dollar appreciates – expect the price of gold to fall.

Second, as rates fall, the yields on fixed income securities drop in tandem. This creates less competition for investor dollars between a hard asset like gold and an income-bearing security like a government bond.

Gold is a precarious commodity and has a poor track record over the long term. In other words, we don’t view gold as an investment. Instead, any involvement in gold is a trade to earn our clients some profits.

Earlier this month, we added a gold royalty company that fits our contrarian investment philosophy to client portfolios. The first rate cut will take place between March and May. We expect our gold trade to benefit our clients’ accounts in the months following that first cut, replicating its behaviour in 2007, 2008, 2019, and 2020.

Once that occurs, we’ll take profits and move on to our next contrarian idea.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.