Fed Policy is a Great Barometer for Presidential Election Outcomes

Lately, many have opined that the Federal Reserve will avoid making major monetary policy adjustments during the same year as a Presidential election.

After all, the Fed is a creation of Congress, and its Chair is nominated by the President itself. The current term of its present chair, Jay Powell, ends in 2026.

Historically speaking, however, a Presidential election has never stood in the way of making an adjustment.

Richard Nixon was infamous for pressuring the Fed Chair Arthur Burns to cut rates as he approached re-election in 1972. He succeeded. Between January 1970 and July 1972, the federal funds rate dropped by over 4 percentage points. In the years following Nixon’s re-election, inflation climbed to 9.6% in 1973, 11.8% in 1974, and 6.7% in 1975. Political aide John Ehrlichman once wrote that Nixon told Burns “I know there’s the myth of the autonomous Fed … and when you go up for confirmation, some Senator may ask you about your friendship with the President. Appearances are going to be important, so you can call Ehrlichman to get messages to me, and he’ll call you.”

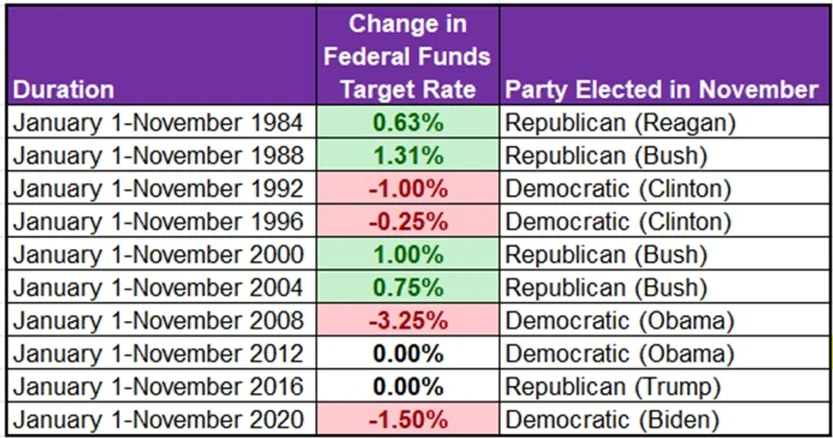

In the ten months leading up to the November vote, the Fed has all but twice adjusted the federal funds rate since 1983, which covers the previous ten Presidential elections.

Despite no change in rates during 2012 and 2016, these two years deserve an asterisk. In 2012, the Fed bought almost $700 billion in long-term bonds to bring down long-term interest rates through its “operation twice” program. And while no actions were taking in the 2016 election year, the Fed hiked rates for the first time since June 2006 on December 16, 2015.

Interestingly, every year that the Fed has eased rates (or added liquidity to reduce long-term rates like in 2012), a Democrat was subsequently elected in November.

We expect the Fed to cut rates as early as March. As of this writing, the market is pricing in the first cut to take place in May. Once rates begin to drop, we expect dividend-paying stocks to appreciate as retirees seek income.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.