Expect Stocks to Rally between Convention Season & Inauguration

The United States’ political conventions began this week. The custom is for the party in the White House to go last, so the Republican convention held this week will be followed by the Democratic convention later in August.

The market usually sells off amid uncertainty. When clarity is offered, it rallies back to higher levels. During a political transition, volatility in stock prices accompanies the uncertainty over which person, party, and platform will be selected to govern for the next several years. The market historically advances regardless of the party in power. For that reason, we treat a market correction during a political election cycle to be a buying opportunity for our clients.

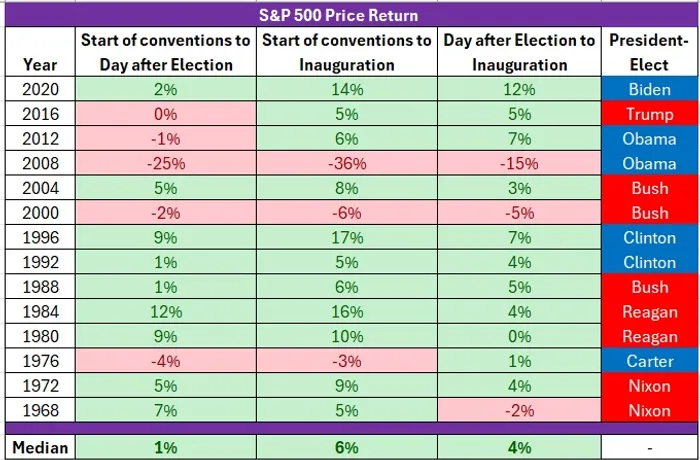

Between the start of the first convention and inauguration day, the market historically rallies +6%. In fact, it’s posted a positive return 11 out of 14 times since 1968. Two of those three negative instances took place during the “dot com” crash in 2000 and the financial crisis in 2008, neither of which had anything to do with the election.

The market has appreciated +4% between the day after the election in November and inauguration day in January since 1968.

There’s not much to be said about the returns between the start of the conventions in the summer and the day after the election in November (the S&P 500 has historically been fairly flat, gaining +1% since 1968).

We went back to 1968 because of its uncanny resemblance to 2024. In 1968, Lyndon Johnson announced in March that he wouldn’t seek or accept his party’s nomination in Chicago later that summer. The Democrats held an open convention in August to select a nominee with no one having secured a majority of the delegates beforehand during the primaries. Two months earlier, an assassin’s bullet killed Robert Kennedy, a senator from New York. Even after winning the nomination, Hubert Humphrey faced public opposition from within his own party.

Next month, the Democrats return to Chicago for the second time since 1968. If Biden chooses not to run, his delegates would be released to presumably vote for a new candidate in an open convention (unless the Democratic party intervenes beforehand to appoint a candidate). While some Democrats vocally oppose Biden’s candidacy – much like they did for Humphrey, albeit for very different reasons – the dissension sounds familiar. Nixon inevitably won the race that year and the S&P 500 rallied +5% in 1968 between the start of the convention season and inauguration day.

In addition to this historical trend, our expectation is for the U.S. Federal Reserve to begin cutting interest rates on September 18. We believe September’s cut will be followed by additional cuts at the November 7 and December 18 meetings. Lower rates will provide another catalyst for higher stock prices.

We expect this historical precedent to repeat itself and for the market to rally between now and inauguration day in January 2025.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.