Blog: Golden Opportunity?

Many often ask, “what does gold actually do?” Warren Buffett has responded by simply saying, “it just sits there.” Unlike other commodities like oil or wheat or coffee, gold is never actually consumed. Every ounce of it ever mined and processed is still available and sitting around somewhere, likely in a drawer.

In Q3 last year, just over half of the demand for gold came from jewellery (53.3%), followed by investments in bars and coins (28.3%), technology (10.1%), and central bank purchases (8.3%). China and India are half the world’s buyers of gold for jewellery. Despite a strong recovery in 2021, however, jewellery demand remains 12% below its five-year average.

Gold is often considered to be a hedge against inflation and insurance against risk. Yet, despite inflation near 7% and the uncertainty about when this pandemic will ever end, gold stocks have continued to lag the broader market.

This week, the latest inflation report indicated that prices rose by 7% in December compared to the year before. This tops the November reading of 6%.

Historically speaking, gold has a weak correlation to inflation. For those with the statistical curiosity, the correlation between gold and inflation has been a mere 0.16 over the last half century (0 indicates no relationship while 1 infers that the two move in unison).

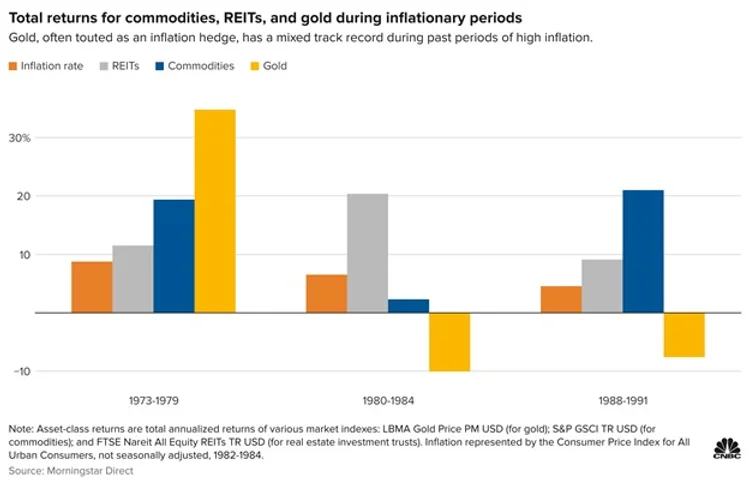

As the chart below illustrates, gold performed well in the 1973-79 period of stagflation during the energy crisis yet produced negative returns during 1980-84 and 1988-91 when inflation was elevated.

In short, gold does not historically respond well to inflation.

On Sunday, March 15, 2020, in an emergency policy action, the US Federal Reserve announced it would reduce its benchmark interest rate to zero and launch a new round of quantitative easing to bring down the interest rate that borrowers paid on US Treasuries.

As fears mounted that the US dollar would depreciate against its global peers amid the economic collapse looming by the COVID-19 pandemic, investors flocked to gold. The day after the emergency announcement, the S&P 500 opened 5.5% below its Friday close while gold stocks surged in price.

Between 1998 and 2008, the US dollar lost its value against other currencies as the country’s debt ballooned and trade deficits widened. Meanwhile, gold nearly tripled before topping out at $1,000 per ounce on St. Patrick’s Day in 2008.

In other words, fears over the future health of the US economy and by extension, the depreciation of its currency, benefits the price of gold.

Is this the Golden Opportunity to Buy Gold Stocks?

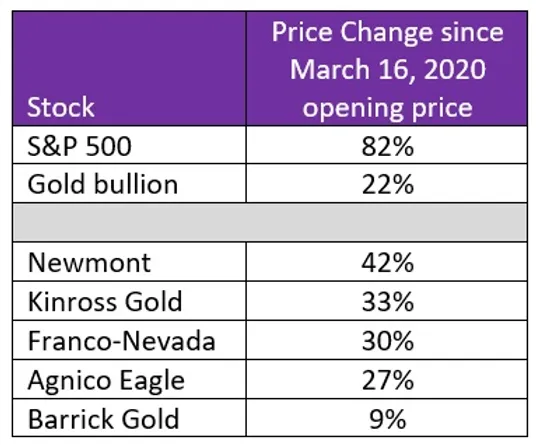

The price of gold bullion and the gold stocks have strongly underperformed the overall S&P 500 since the emergency interest rate cut to zero was announced on Sunday, March 15.

With US rate hikes universally expected to take place this year (the market currently anticipates four hikes in 2022), that normally bodes well for the local country’s currency… if it happens. Certainly, a new variant of COVID-19 would impact those intentions. Furthermore, with only 61% of Americans fully vaccinated at the time of this writing, the US is more likely than other geographies to resist future shutdowns or mobility restrictions, which would prolong the economic slowdown of an additional variant.

Finding an alternative to the US dollar as it depreciates against other currencies no longer leads exclusively to gold. Cryptocurrencies – and there are several of them – have attracted the interests of investors and speculators that once flocked to gold. We expect the cryptocurrency market to attract the attention of regulators eventually. When it does, this won’t bode well for its demand.

We believe there are gains to be made owning gold stocks. This is because of the possibility that a new COVID-19 variant will deter the US Federal Reserve from hiking rates four times in 2022; the ever-growing debt in the US that will inevitably depreciate its currency; and the gold stock underperformance relative to the broader market. However, these factors will also trigger additional interest in cryptocurrencies, which have captured the attention of many natural gold investors in recent years, and will compete with gold for future investment dollars.

DISCLAIMER: The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice to assess your goals and objectives, personal circumstances, and make an informed suitability assessment.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.