Blog: Banking on the Past

Investors that pay close attention to historical market trends note that the strategy to purchase the prior year’s worst-performing Canadian bank stock relative to its four domestic peers has accompanied an impressive track record of growth over time.

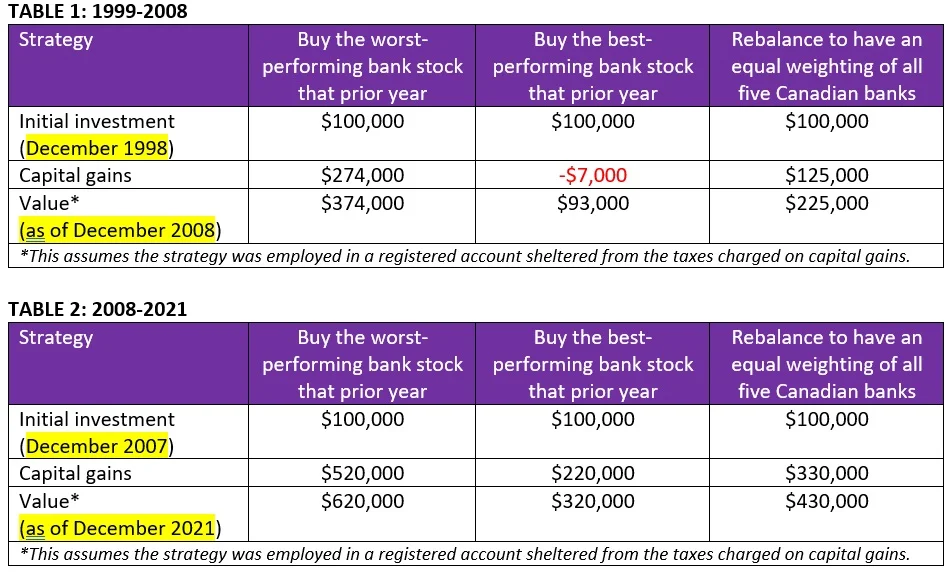

Consider the following situation. An investor could annually rotate their Canadian bank investments in late December each year and buy that year’s worst-performing bank stock, which would then be held as the sole Canadian bank holding in their portfolio over the next 12 months; alternatively, the investor could do the opposite and buy the best-performing bank stock from that prior year; or, the investor could simply rebalance each December to own an equal proportion of all five Canadian banks stocks heading into the New Year.

As seen in the two tables below, each covering a different period (1999-2008 in table 1 and 2008-2021 in table 2), buying the worst-performing bank stock would have led to superior capital gains in both situations.

Following the financial crisis that began in 2008, Canadian banks have adapted to comply with a substantial number of additional regulations and significantly more capital reserve requirements. The quality of each bank’s mortgage portfolio, business segment diversity, and geographical diversification is now more heavily scrutinized than it was before. Consequently, the strong quality of Canadian bank assets led us to favour Canadian bank ownership in all client portfolios.

This year, Royal Bank underperformed its peers (appreciating in price by 33% as of this writing), while BMO performed the strongest (up 46% in price as of this writing).

Because of this historical pattern observed above, we will own the Royal Bank in client portfolios throughout 2022. In addition, because of our fondness for the sector, we also favour Scotiabank for its attractive dividend yield (4.5% as of this writing) and valuation discount compared to the historical premium it once commanded. Scotia’s global business, which is predominately situated in Latin America (Mexico, Chile, Colombia, and Peru), was most severely impacted by the COVID-19 outbreak relative to its peers. As vaccines disseminate globally, we see a brighter future ahead for the bank.

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.