Banking on the Past & Why We Bought Canadian Western Bank

Investors that pay close attention to historical market trends note that the strategy to purchase the prior year’s worst-performing Canadian bank stock relative to its four domestic peers has accompanied an impressive track record of growth over time. (Note that we are only looking at RBC, TD, BMO, Scotia, and CIBC here).

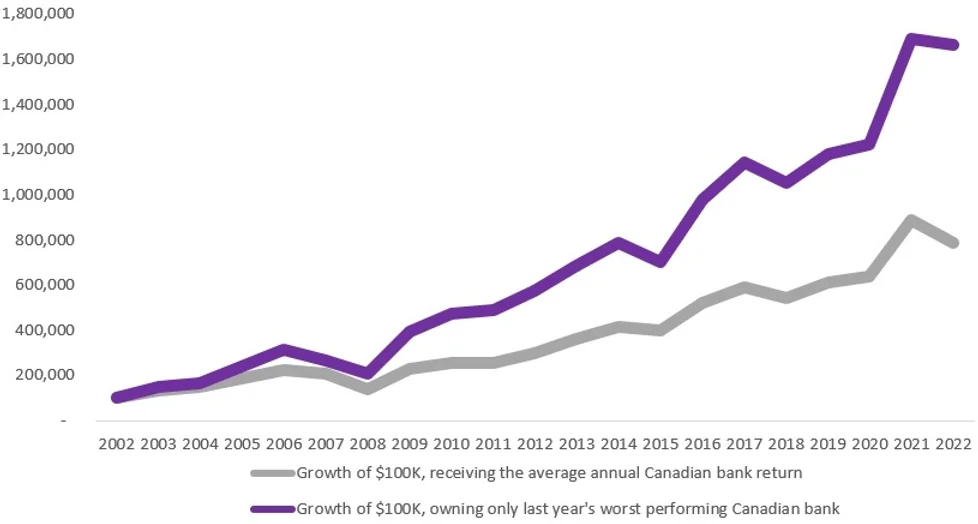

Consider the following situation. An investor could annually rotate their Canadian bank investments in late December each year and buy that year’s worst-performing bank stock, which would then be held as the sole Canadian bank holding in their portfolio over the next 12 months; alternatively, the investor could rebalance each December to own an equal proportion of all five Canadian banks stocks heading into the New Year.

As you can see, buying the worst-performing bank stock would have led to superior gains than owning an equal portion of the Canadian banks each year.

Because of this historical pattern observed above, our top pick for 2023 is the Bank of Nova Scotia, which posted the worst performance relative to its peer group last year after falling 22.8% (including dividends). The stock accompanies a 6.2% dividend yield and trades at an inexpensive 8.2x price-to-earnings multiple.

Aside from the “big 5” names, we recently added a regional bank. On December 2, Canadian Western Bank reported its most recent quarterly results. The stock dropped almost 5% the next day. On December 5, we took advantage of the pullback and purchased the stock for suitable clients at $23.95. Today, it closed at $26.91, up about 12%. As the name suggests, its loans are primarily situated in British Columbia (33%) and Alberta (31%). At the time of our purchase, the stock traded at a 27% discount to its book value and offered a 5.3% dividend yield. We plan to hold the stock until it achieves its book value, which is $33.48, up another 24% from here. Our team regularly researches new stock ideas for clients. If the price makes sense, we’ll buy it. Otherwise, we’ll move on to our next idea. Because we have previously looked at CWB, we were able to move quick on our purchase.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.