Oh, Canada

During the fall, over 90 high-ranking business executives expressed concern in an open letter that Canada’s largest pension funds should bulk up their investment positions here at home.

The eight largest pension funds – also known as the “Maple 8” – manage 38% of Canada’s savings. Yet, that collective group has reduced their holdings of publicly traded Canadian companies from 28% of their total assets in 2000 to less than 4% at the end of last year.

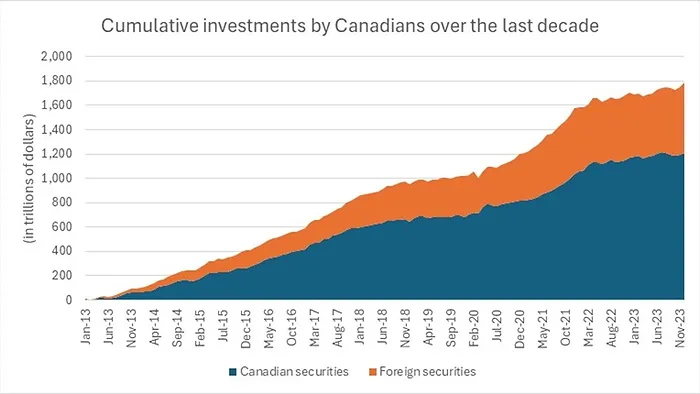

The flight away from Canada has grown larger and larger each year. In December, Canadians bought almost $30 billion of foreign securities, the highest amount ever recorded in a single month.

Investing in Canadian companies is good for all sorts of reasons. If our domestic companies have a larger pool of investment dollars behind them, they can more easily borrow from lenders. With that additional money, businesses can invest in the economy and add new. This bolsters our country’s economic growth and strengthens the employment situation.

This is also facilitated because a stock trading at a higher valuation can be used as a currency to raise much needed funding for a growing company. If a company needs cash to do something, it can borrow from a bank; issue a bond and promise to repay the proceeds with interest; or print more share certificates to be sold to investors. Proceeds from a stock sale could be used for reinvestment in the business or their employees.

So, what can we do to get Canada’s stock valuations back on track?

Idea #1: Raise Canada’s Dividend Tax Credit

With few exceptions, the largest companies on the S&P/TSX Composite Index pay a dividend. All the banks, telcos, and utilities are known for both their sizable dividend yields as well as their history of raising the amount per share that is paid out in dividends each year.

Dividends paid by a Canadian stock are attractive to investors because of the dividend tax credit. Increasing that credit – not somewhat, but substantially – would accompany a greater appetite for Canada’s dividend-paying stocks. Additional dollars invested in Canadian dividend-paying stocks would bolster their valuations.

Idea #2: Invest in Canada Early for Newborns

Have you ever said to yourself, “I wish my parents put $10,000 in an index fund the day I was born and just left it alone?” Probably not, but I have.

Do you ever worry that Canada’s federal government is going to bankrupt itself with all the people unprepared for retirement? Probably yes.

Many just aren’t wired to save money. When it comes time to retire, it’s sadly not an option for everyone.

Provided that the beneficiary is not able to cash the proceeds until age 65, imagine if the government were to put $10,000 into an index fund that tracked the S&P/TSX Composite Index on behalf of every newborn. If the total return were, say, 6% each year, that $10,000 would be worth $440,000 in 65 years.

With about 350,000 births in Canada each year, it would cost a lot of money in dollars. To be exact, $3.5 billion. However, that would represent only 0.7662% of Ottawa’s annual revenue.

Idea #3: Tax Breaks for Small Businesses that Buy Canadian Equities

Though Canada has grown by 10 million people over the last 20 years, it has 100 thousand fewer entrepreneurs today than in 2000.

There should be more incentives to start a small business. Afterall, we invented the telephone, the alkaline battery, peanut butter, and the sport of basketball.

Rather than tax profitable start-up companies right out of the gate, providing some early relief from their inevitable tax burden would encourage new ventures.

Why not exempt small businesses from having to pay tax on their first $500,000 of profit, provided that same amount is used to buy Canadian equities?

We believe these ideas would help bolster Canada’s stock valuations. In turn, Canada’s economy could grow more robustly, and its employment fundamentals would improve.

Canada’s much smaller and less followed market does present great opportunities for Schneider & Pollock’s clients. It’s easier to find undervalued and underfollowed investment opportunities with fewer eyes watching Canada. We are, however, hopeful that public policy efforts will be made to curb the outflow of capital into jurisdictions abroad.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.