Apple’s Bruises Make it a Tough Stock to Pick Today

Is it just me or did the glory days of Apple seem to die with Steve Jobs? (Disclosure: Jeff Pollock and Sunni Schneider hold no financial interest in Apple.)

Apple’s iMac (1998), iPod (2001), iPhone (2007), and iPad (2010) were revolutionary products when first introduced. Each were unique, customer-friendly, and attached a superior graphical interface compared to the alternative devices at the time.

Jobs died in October 2011 at the premature age of 56.

While the stock price has appreciated considerably since 2011, does Tim Cook deserve credit for that, or was it Steve Jobs’ vision that simply took a decade to evolve?

Today, its customers are locked into the Apple ecosystem, which is partly the reason why the Department of Justice launched an antitrust case against Apple earlier this month.

According to Bill Gates, who experienced an antitrust battle himself in the 1990s while running Microsoft, the high cost of this kind of litigation is not the monetary expense but rather its distraction to senior management. “We would have been more focused on creating the phone operating system. … [I]nstead of using Android today you would be using Windows Mobile. … [W]e were so close, I was just too distracted,” said Gates.

Apple is not an inventor.

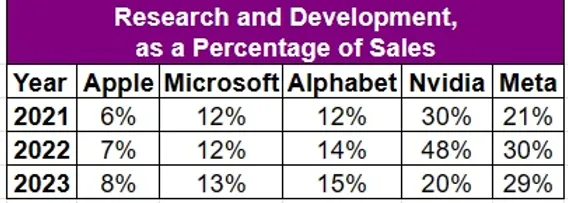

When compared to other technology companies like Microsoft, Alphabet (aka Google), Nvidia, and Meta Platforms (aka Facebook), Apple’s research allocation pales in comparison. Last calendar year, Apple spent 8% of its total revenue on research and development while Microsoft, Alphabet, Nvidia, and Meta were all in the double-digit range.

In February, press reports said that after a decade of work, Apple cancelled its entire Special Projects Group. The group employed thousands of people over the last decade to introduce an electric vehicle. A decade of work down the drain! The plan was to rival Tesla with a revolutionary car of its own. Going forward, those investment dollars will be reallocated to artificial intelligence.

Given that Apple has a net cash position of $67 billion, can’t they juggle both AI and developing a car?

However, Apple has been largely absent from the AI conversation. In fact, another report surfaced last month that Apple is in talks with Alphabet to have the latter company’s Gemini AI software installed on a future iPhone.

Since Steve Jobs’ passing, there haven’t been any revolutionary products.

Yet, the stock’s valuation has continued to expand, making it more and more expensive every year. When Jobs died, Apple’s stock traded at 8.6x the next year’s earnings. By comparison, the S&P 500 traded at 11.7x earnings back then. In other words, Apple traded at a 26% discount to the overall market. Today, Apple’s stock trades at 24x earnings, a 10% premium to the S&P 500’s 22x multiple.

Because we see earnings growth in the mere single digit percentage range for the next few years, a valuation multiple exceeding twenty times earnings is simply too expensive for us to buy at today’s price.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.