Musical Chairs at the Federal Reserve Historically Sings Well for the Market

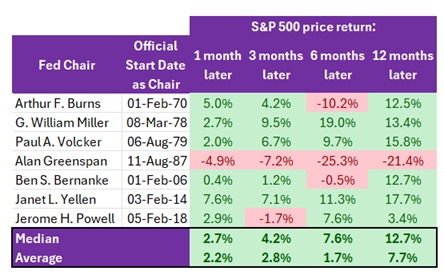

While leadership changes at the Fed can spark uncertainty, the S&P 500 historically rallies whenever a new U.S. Federal Reserve Chair is appointed. In fact, going back to 1970, the S&P 500 has gained 12.7% in the twelve months that follow.

This data is particularly timely, as Jerome Powell’s term ends on May 15, 2026.

The chart adjacent shows that the market not only posts strong 12-month returns, but also solid gains 1-month, 3-months, and 6-months afterward.

We should note that 1987 is a clear outlier, due to “Black Monday,” when the Dow Jones fell 23% for reasons unrelated to the Federal Reserve.

We expect this historical pattern of market gains to recur in 2026 for two reasons.

The Market Would Cheer a Rick Rieder Chairmanship

Today, the predictions market assigns a 47% probability that Trump will nominate Rick Rieder as the next Fed Chair.

Such an appointment would likely be welcomed by investors. As a Senior Managing Director at BlackRock, Rieder manages approximately $2.4 trillion in assets. His extensive bond market expertise positions him as a market-friendly candidate.

Rate Cuts to Continue in 2026

Bull markets don’t die of old age. Central banks often kill them off with higher rates.

In 1996, Alan Greenspan famously warned of “irrational exuberance”, particularly in the technology sector. However, that didn’t mark the peak of the tech bubble as many people presume. Instead, Greenspan’s comment was minted on December 5, 1996. The Nasdaq closed around 1,296 later that day and would climb another 289% over the next 3 years before the “dot com” bubble eventually burst.

Leading up to the Nasdaq’s peak on March 10, 2000, the Fed hiked rates five times in 1999 and early 2000 (+0.25% on June 30, 1999; +0.25% on August 24, 1999; +0.25% on November 16, 1999; +0.25% on February 2, 2000; and +0.25% on March 21, 2000). Following these rate hikes, the market plunged considerably.

For the balance of 2026, we expect two more rate cuts in the U.S. If higher rates are proposed, we will adjust our stance. As long as no hikes are anticipated, we remain bullish and fully invested for our clients.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.