Questions from Prospective Clients

Over the past few months, we’ve met with many prospective clients who often share similar questions. We’ve collected the most common ones to provide a clear view of how we operate.

When did you start the company?

We were first registered on February 1, 2022. Currently, we are registered to do business in Ontario, Alberta, British Columbia, and Nova Scotia.

A lot of other firms require a million-dollar minimum. Why?

Many firms require high minimums because smaller accounts generate lower fees.

We don’t require a minimum. If someone believes in our contrarian philosophy, we’re happy to work with them. Everyone receives the same level of service, whether they’re starting out or already well established.

Is it just Jeff and Sunni?

It’s uncommon for a discretionary portfolio management firm to be successfully run by just two people, but we’ve made it happen.

It took us two years to get our infrastructure to its current state, and many people are genuinely surprised by how structured and organized we are. For our internal operations, we’ve divided our company into eight separate silos: Clients, Investments, Compliance, Financials, Corporate Governance, Marketing, Prospects, and Operations. We review each silo on a rotating basis every day.

Additionally, we rely on key third-party service providers that help us ensure the firm functions efficiently and compliantly. For instance, the National Bank Independent Network (NBIN) is our custodian, where all client assets are held for safekeeping, and they provide a support team we rely on when necessary. We also retain outside legal counsel and accountants to assist with the firm’s overall governance.

To prepare for unforeseen events, our Business Continuity Plan is reviewed and updated at least quarterly.

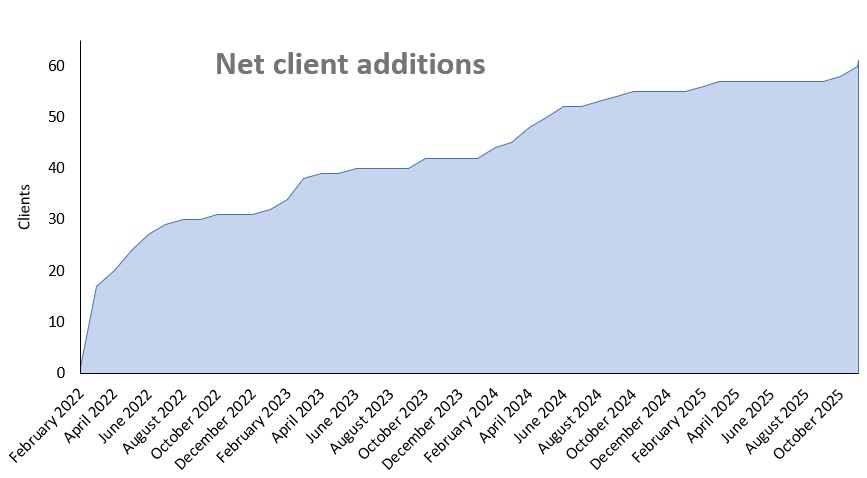

How many clients did you start with?

We started with zero clients. Our first client joined us in February 2022, and we have gradually grown ever since. Right now, we have 61 clients and expect to add a few more before year-end.

How do you pick stocks?

We search for securities that are temporarily out of favor with the broader market. When a company’s stock price experiences a significant decline, our research focuses on determining the root cause of the drop: is the problem driving down the price temporary in nature, or does it represent a deeper, structural problem? A temporary issue, like an overreaction to a minor product delay, presents a prime buying opportunity. In contrast, a structural problem, such as permanent technological obsolescence or insurmountable debt, signals a fundamental impairment that we avoid.

For instance, in early 2023, shares of Alphabet (formerly Google) fell double-digits following a glitch during a presentation of its new AI product. (Disclosure: Jeff Pollock and Sunni Schneider hold direct and indirect financial interests in Alphabet as shareholders.) We assessed this to be a fixable, temporary problem and purchased the stock for our clients in February 2023, paying about $97 per share, confidently believing the company would resolve the issue. This belief proved successful, as the stock is now trading significantly higher at around $320 a share, validating our approach of capitalizing on market pessimism driven by short-term noise.

Are there downsides to having a custodian?

No, we don’t believe so. A custodian like NBIN serves as a safekeeper of client assets. There are absolutely no conflicts of interest, as our investment process is entirely run in-house, and any relationships the custodian may have with corporate clients are irrelevant to our investment decisions.

NBIN also runs a trading desk that helps us to achieve our best execution needs for client trades.

I like to see my assets at my bank. Now that they have moved to National Bank, how will I know what my money is doing?

We ensure you have complete visibility into your portfolio. The same month we open a new account, we provide the new client with login credentials so they can check in on their portfolio as often as they like.

Beyond that, we send a monthly account statement that shows any trades made, the names and quantities of each security owned, and our commentary. We also commit to conducting regular meetings as often as the client wishes to review the portfolio and discuss personal circumstances.

We hope this provides a helpful overview. If you have other questions, we’d be happy to answer them. Please feel free to reach out to us at info@schneiderpollock.com or 416-646-0756.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.