The Reason We Sold Hudbay Minerals After the Stock Rose +120%

In July 2022, we made a block trade purchase to buy shares of Hudbay Minerals (“HBM”) for $4.77/share for suitable clients. Recently, we sold the position across the board for $10.46/share. (Disclosure: Jeff Pollock and Sunni Schneider not longer hold any financial interest in HBM.)

HBM is a copper and zinc producer with assets in Peru, Canada, and the United States. We’ve all heard the reasons why copper is an enticing investment.

- The commodity is scarce, and demand will very soon outweigh supply.

- The infrastructure needed to facilitate any kind of mass AI adoption will require copper.

- Electrification, too, will consume a whole lot more of the red metal than what is being used today.

However, commodity stocks are trades rather than long-term buy and hold investments.

We use technical analysis to find opportunistic trades for our clients. Unlike fundamental analysis, which involves researching the company’s attributes and financial metrics, technical analysis focuses entirely on the chart. By studying pricing patterns, our objective is to understand psychological decision-making behind the people trading the stock.

While we bought HBM based on our fundamental analysis of the copper market, we sold it based on the chart.

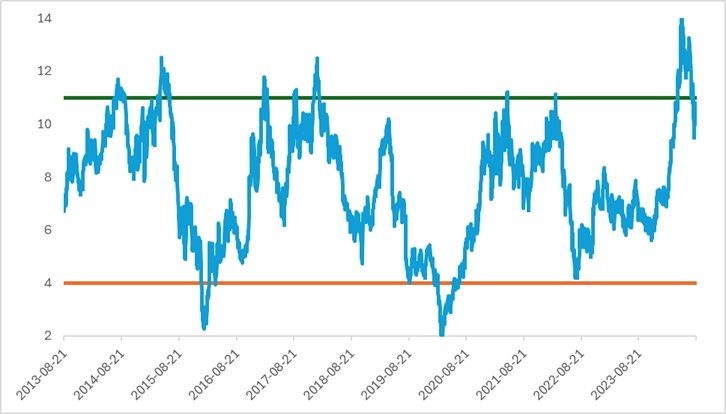

Looking at a long-term stock chart, HBM historically faces resistance at $11/share. Many traders would have bought the stock at $11/share only to see its value decline thereafter. Once the price returned to $11/share, many people would have rejoiced to finally be in a break-even position. Unsurprisingly, those same people would be quick to sell their position. For that reason, the stock has historically had trouble trading over $11/share because many sellers enter the market at that level.

When we bought the stock for $4.77/share in 2022, we had no doubt that the stock would eventually hit $11/share. The timing it would hit that price, however, was uncertain. We didn’t wait exactly for our target. Instead, we sold the stock at $10.46/share.

Because we like the fundamental backdrop behind the copper market, it’s very likely we’ll trade this stock again. However, another 120% gain is probably unlikely. We would trade this stock again for a 20% return, which implies buying it back if the price dropped below $9.20/share.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.