Peak Inflation?

The latest reports pegged inflation at 8.6% in the U.S. and 7.7% here in Canada. While price growth has been mostly broad-based, higher energy costs are by far leading the way, up 35% both north and south of the border. Excluding energy, inflation in Canada would have been 5.8% last month.

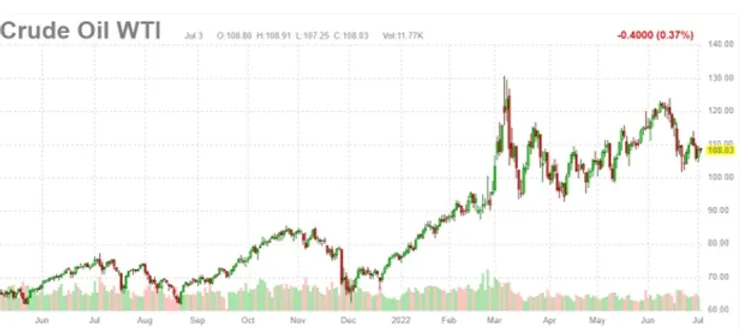

Oil is 10% Off its High

High gas prices have started to impact consumer behaviour. Here in Ontario, as the price at the pump hit a very psychological $2.00/litre, many changed their behaviour. Even back in May, a Leger survey found that two-thirds of Canadian were cancelling or at least altering their summer vacation plans because of higher energy costs.

Recently, prices have dropped. After hitting an average $2.12/litre in Ontario, the average gas price is now $1.895/litre, its lowest level in a month. Keep in mind the province cut the gas tax by 5.7 cents per litre on Canada Day. In the U.S., the average gas price stands today at $4.812/gallon after topping $5.016/gallon on June 14, 2022. Interestingly, gas demand has fallen by 2% compared to the end of June last year while supply has increased by about 1%.

While a couple of weeks isn’t long enough to establish a definitive trend, things are moving in the right direction to suggest we have already seen peak energy inflation. The Ukraine invasion has created an energy shortage and any resolution abroad would bring down the price of oil.

Figure 1: West Texas Intermediate oil price

Asking for a Salary Hike is Getting More Difficult

Inflation can become self-fulfilling when everyone expects it to continue. Workers ask for higher wages and salaries, businesses raise prices in anticipation of higher costs, and the vicious cycle continues.

However, it may be possible that wage inflation has already peaked too.

According to data compiled by the Atlanta Federal Reserve, wage inflation historically falls quite substantially following a recession (see the chart below – the shaded bars represent a recession). We believe the U.S. is already in a recession and that it began at the start of 2022. The real gross domestic product (“GDP”), which measures the total size of the economy, declined by -1.6% in the first 3 months of 2022.

We believe the economy also declined in Q2, which ended on June 30, particularly after learning that consumer spending grew at only 0.2% in May, down from 0.6% in April. The data for June’s consumer spending comes out on July 29th. Consumer spending constitutes two-thirds of the U.S. economy and numbers this low suggest anything other than economic growth. We’ll get the Q2 gross domestic product reading on July 28th and can know for sure if the U.S. is in a technical recession by then.

While wages are presently growing at 5% in the U.S., it’s much harder to ask for a salary increase during a recession. While this is an incredibly tight labour market with more jobs available than people, we’re reading more and more stories about job offers being rescinded and cutbacks announced and believe this has not yet been reflected in the backward-looking economic data.

For example, Mark Zuckerberg told his Meta Platform (that’s the new name for Facebook) employees last week that “some of you shouldn’t be here” as the company announced cutbacks to brace for tougher times ahead. Further, Elon Musk earlier in June said that Tesla will lay off 10% of its salaried employees.

Figure 2: Wage growth tracker (note: shaded bars indicate a recession)

Once We See Peak Inflation… Then What?

The next Consumer Price Index (“CPI”) report comes out on July 13th. It’s not so much the headline number that matters so long as it’s decelerating from the previously reported inflation rate. Once we see a couple readings in a row showing inflation growth decelerating, more buzz that inflation has in fact “peaked” is likely to dominate the discussion between market participants.

Once that happens, we expect a material market rally. The Federal Reserve will likely then pivot to a more dovish tone (they hiked rates by 0.75% last meeting, three times the typical rate increase), particularly given the likelihood that the U.S. economy is already in a recession. In the previous seventeen inflationary episodes, the S&P 500 appreciated 13.2% in the 12 months following the peak of inflation.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.