2023 Has Been a Rocky Road So Far

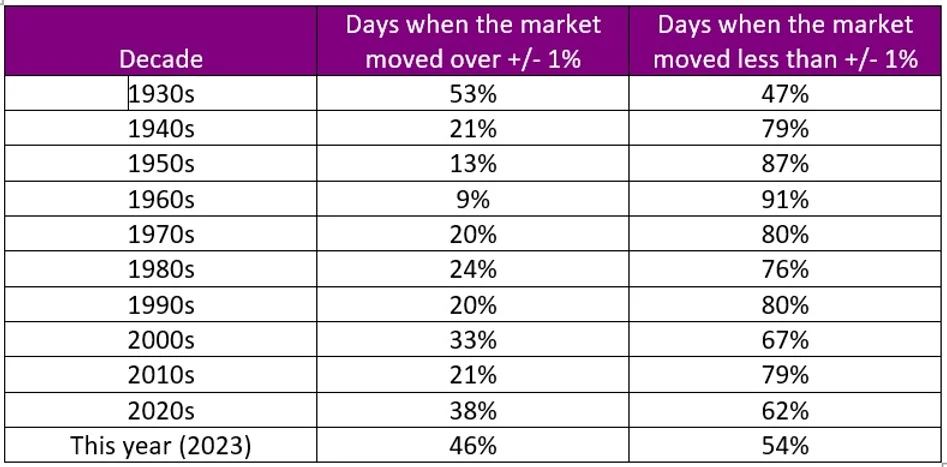

While we are only two months into the year, the market has exhibited heightened volatility. In fact, the S&P 500 has moved more than plus or minus one percent in 46% of the trading days so far this year. This compares to 24% of the days since 1930 that posted a daily return which exceeded plus or minus one percent.

There were many uncertainties when 2023 began. When will the Federal Reserve stop hiking rates? When will the war in Ukraine end? Are analysts estimates for corporate earnings too optimistic? Will the economy slip into a severe or mild recession (or no recession at all)?

We don’t have an answer to all these questions. However, we do take advantage of the market volatility that accompanies this uncertainty. When the price of a stock on our watch list declines beyond a warranted amount, we will buy it. Similarly, if a stock price exceeds what we believe to be its intrinsic value, we will go ahead and sell it (provided you own it – in other words, we will not “short sell” a security).

There are many uncertainties in the news today. However, since stocks began trading in year 1611, there have always been uncertainties. The time to become nervous is when everyone is optimistic.

We believe that 2023 will deliver positive market returns. Since 1946, the market has delivered a positive annual return about 70% of the time. There have only been three instances since 1946 when the S&P 500 declined two years in a row. When the decline is steep, as it was in 2022 (the S&P 500 dropped by 19.4%), the subsequent year historically produces a very strong positive return.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.