GICs are Guaranteed to Disappoint for these 3 Reasons

Many have been looking more closely at the rates offered by a Guaranteed Investment Certificate, also known as a “GIC”. Some ask, “why take on equity risk when I can buy a GIC and earn a 5% return for a couple of years?”

There are many reasons.

First, if you have a time horizon beyond just a couple of years, stocks far outperform 5% in the long run.

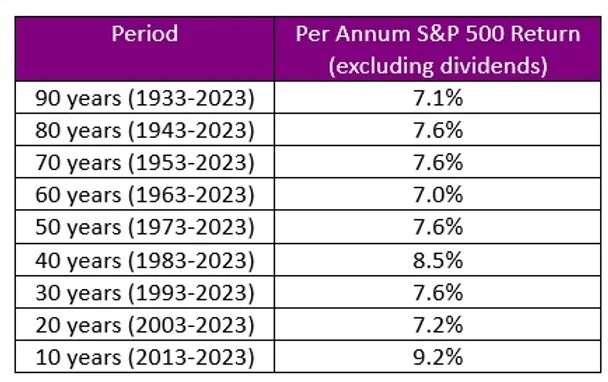

Have a look at the chart below. This looks at the return per annum using a bunch of different time horizons.

So that no one thinks we are “data mining”, or selecting the most favourable time period, we’ve taken the per annum return for the S&P 500 using a bunch of different starting points over the last 90 years.

Take the worst period, which is the column entitled “60 years (1963-today)”. At 7.0% per year, your money doubles in 10.2 years. By comparison, that 5.0% GIC return would take 14.2 years to double. And that assumes a zero percent tax rate, which brings us to the next reason why stocks are preferable over fixed income.

Second, there’s significantly different tax treatment for the money you make on a GIC compared to the capital gains on a stock outside of a registered account (RSP, RIF, TFSA, RESP). GICs pay “interest income”, which is fully taxable at your marginal tax rate. Depend on your income bracket, the taxes owed can be quite high and may substantially reduce your return.

By comparison, stocks are taxed much more efficiently.

If you realize a capital gain, which is incurred simply by purchasing a stock and selling it at a higher price, only half that profit is taxed at your marginal rate. If you buy a stock and sell it for a lower price, you’ve realized a capital loss, which can be carried forward forever and matched against a future realized capital gain.

Last, but not least, there’s the risk that when your GIC matures, the rate being offered on the next GIC will accompany a lower interest rate. This is called “reinvestment risk”. All it takes is an emergency for central banks to drop rates to zero. If that happens, GIC rates will follow. In the last 15 years, rates have taken the stairs on their way up and the elevator on the way back down. Just think about the financial crisis in 2008-9 and then the pandemic in 2020.

After all, rate hikes are likely complete.

If rates have stopped going up, does that mean they drop back down? Probably, especially because of the debt Canadians owe.

Bank of Canada Governor Tiff Macklem said this week that:

One of the important reasons why we held our policy rate of 5% is that we know that those [Canadian mortgage] renewals are coming. So, we know that there’s more to come from what we’ve already done. … That’s why we have a forecast for weaker growth.

While many stocks have disappointed investors so far this year, it’s vital to stay focused and keep your eye on the long-term potential returns for stocks.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.