Tesla is Driving Out of Control

Now trading 60% off its all-time high, Tesla shareholders have seen the value of their investment collapse by just about 35% so far this year. (Disclosure: Jeff Pollock and Sunni Schneider do not hold a financial interest in Tesla.)

Normally, this is the exact kind of contrarian opportunity that we would flock to for our clients. We like buying stocks that are out of favour. This is because our best returns have historically stemmed from market dislocations.

But, Tesla’s stock price has made a full round trip for three good reasons – all of which justify a much greater discount to today’s valuation.

First, Tesla’s governance is atrocious under its CEO, Elon Musk.

Remember that Tweet, “Am considering taking Tesla private at $420. Funding secured.”? Or how about that weird podcast that Musk recorded with Joe Rogan?

Normally, you would expect the board of directors to intervene. However, Tesla’s board is hardly independent from its CEO. That’s according to a Delaware Chancery Court judge, who described its directors as “beholden” to Musk in February 2024.

I couldn’t help but notice these two headlines while reviewing my news feed last week.

Seriously?

The line between Musk’s pet projects and Tesla’s best interests is very foggy. Shareholders deserve a full time CEO but Musk’s time is divided between Tesla, Twitter, SpaceX, and one courtroom to the next.

Second, competition is becoming fierce. Not only did BYD recently dethrone Tesla as the world’s top EV producer, but Volkswagen, Hyundai, Daimler, GM, Ford, Toyota, and others now sell electric vehicles too. Competition has created an intensifying price war. Just over the weekend, Tesla announced price cuts in the US, China, Germany, and parts of Europe.

Third, and most importantly, the demand for electric vehicle adoption has faded.

In the first quarter of this year, Tesla’s global sales declined by over 9% compared to the year before, its steepest drop since 2012. And it’s not just Tesla facing tepid interest. GM’s CEO Mary Berra is scaling back her EV rollout plans to now include hybrid vehicle production. Ford’s CEO Jim Farley also said he will delay or cut $12 billion from their EV budget.

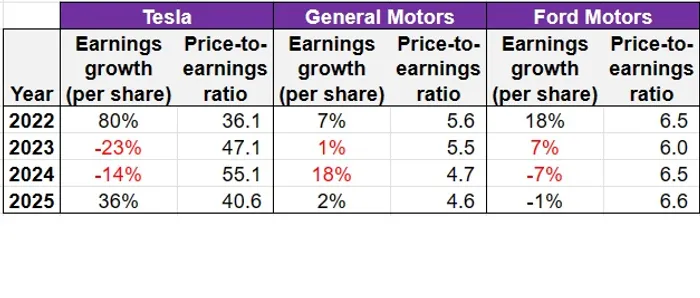

Despite these shortcomings, Tesla’s valuation still makes no sense. While other car companies carry a single digit price-to-earnings multiple, Tesla accompanies a valuation ten times as rich. A premium growth company multiple is justified when, well, a company has growth.

Every Tesla bull will tell you that “Tesla isn’t a car company.”

We agree.

It’s a cult following – one where many turn a blind eye to valuation and pay a premium for its mere association with Elon Musk.

We would pass on purchasing Tesla’s stock for our clients because of its poor corporate governance, heightened competition, and the fading demand for electric vehicles that does not justify its valuation at today’s stock price.

-written by Jeff Pollock

DISCLAIMER: Unless otherwise noted, all publications have been written by a registered Advising Representative and reviewed and approved by a person different than its preparer. The opinions expressed in this publication are for general informational purposes only and are not intended to represent specific advice. Any securities discussed are presumed to be owned by clients of Schneider & Pollock Management Inc. and directly by its management. The views reflected in this publication are subject to change at any time without notice. Every effort has been made to ensure that the material in this publication is accurate at the time of its posting. However, Schneider & Pollock Wealth Management Inc. will not be held liable under any circumstances to you or any other person for loss or damages caused by reliance of information contained in this publication. You should not use this publication to make any financial decisions and should seek professional advice from someone who is legally authorized to provide investment advice after making an informed suitability assessment.